Professional Documents

Culture Documents

Pagi Meeting Template (PROCUREMENT) - 22012021

Pagi Meeting Template (PROCUREMENT) - 22012021

Uploaded by

aji widiatmokoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pagi Meeting Template (PROCUREMENT) - 22012021

Pagi Meeting Template (PROCUREMENT) - 22012021

Uploaded by

aji widiatmokoCopyright:

Available Formats

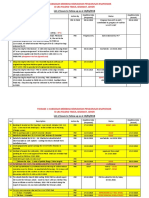

Procurement Priority Issues (Masrukhan)

No Topic Issues / Measures Action PIC

Tooling - Tooling of FE Model was accepted by KTB to be 1. Production part (~Apr ‘21) SPI

Disposal disposed 2. Delivery part to KTB SP (~Apr ‘21) SPI

- KTB release "last order" for some parts that still 3. Dispose tooling at SPI (~Apr ‘21) PE/Proc/Scrap Buyer

Proposal – have demand

1 MFTBC Model - SPI will do production and delivery until April ‘21

due to maximum regular production

loading/capacity

MMKI OEM - April ~ September ‘20 Period 1. MMK request detail data of Vendor price for

Sales Price MMKI request detail price explanation regarding further verification and detail check (Portion

increment of transport price & exchange rate of Material Price, Forex, and Inflation)

- October ‘20 ~ March ‘21 Period

Proc will propose in January ’21 2. Submit and explain detail vendor price to Proc

-> Ex rate: MKM not use MMKI exchange rate, MMKI (~26 Jan ‘21)

because SCI use exchange rate based on actual

“paid date” to Metal One Japan (Rp/USD 14.xxx) 3. Target release price confirmation Proc/MMKI

2 (~29 Jan ‘21)

SL Category A - MMKI request itemize frame part of SL 21MY 1. Price calculation& structure (~22 Jan ‘21) Proc/Co/PE

2. Price explanation to BOD (~25 Jan ‘21) Proc/Co

3. Price submission to MMKI (~26 Jan ‘21) Proc

SL Production MMKI inform increasing SL Forecast Jan – Mar ’21: 1. Final confirmation for material delay Proc

Vendor Potential Problem Confirmation: shipment from MEAINA & Yasunaga

Up Forecast

3 1. SPI : pallet qty not cover & prod capacity 2,800

pcs / month

(~18 Jan ‘21)

2. Inform to MMKI (~18 Jan ‘21) Proc

2. MEAINA: material delay shipment

3. Yasunaga: Material, no space for buffer stock

SL21MY Invest Total tooling investment cost: Rp. 23.3 Billion 1. Follow up on progress tooling (~Dec 18, ‘20) Proc/PE-S

Total 25 items: 13 items was finished, 11 on

4 Tooling Cost progress, 1 canceled by MMKI

You might also like

- Final Project (Fatima)Document21 pagesFinal Project (Fatima)hasnain kaxmyNo ratings yet

- Snapdeal MISDocument16 pagesSnapdeal MISApoorv SrivastavaNo ratings yet

- Face To Face Meeting - August 2020 (Sales)Document286 pagesFace To Face Meeting - August 2020 (Sales)aji widiatmokoNo ratings yet

- Monthly Meeting With AMW-2018-07-27Document12 pagesMonthly Meeting With AMW-2018-07-27GalkandaNo ratings yet

- Minutes of Special Meeting No 5 - 5 October 2019Document5 pagesMinutes of Special Meeting No 5 - 5 October 2019Bianca SamaleaNo ratings yet

- List of Issues To Follow-Up (PBE) 10.04.2018Document9 pagesList of Issues To Follow-Up (PBE) 10.04.2018Poru ManNo ratings yet

- Part-A: Reporting Period Milestones Compliance: (Give With Specific Examples. Minimum 1 and Maximum 6 Examples.)Document1 pagePart-A: Reporting Period Milestones Compliance: (Give With Specific Examples. Minimum 1 and Maximum 6 Examples.)Subhakanta SwainNo ratings yet

- F2F Meeting Oct '22 (Sales)Document1 pageF2F Meeting Oct '22 (Sales)aji widiatmokoNo ratings yet

- Construction Plan Erection SS RMS (19022022)Document51 pagesConstruction Plan Erection SS RMS (19022022)AbasNo ratings yet

- Fworkz MOM 9jun22Document141 pagesFworkz MOM 9jun22Patricia NoroñaNo ratings yet

- Monthly Meeting With AMW-2018-06-13Document17 pagesMonthly Meeting With AMW-2018-06-13GalkandaNo ratings yet

- Technical TrainingDocument1 pageTechnical TrainingRama Satish K VNo ratings yet

- Week 43-2023 RMB Activity ReportDocument1 pageWeek 43-2023 RMB Activity Reportjhun michael locusNo ratings yet

- List of Issues To Follow-Up (PBE) 12.03.2018Document2 pagesList of Issues To Follow-Up (PBE) 12.03.2018Poru ManNo ratings yet

- 6 CP NS-01 BD Draft Part 3 Vol.4 EM Version 11.0 FINAL Rev ADocument72 pages6 CP NS-01 BD Draft Part 3 Vol.4 EM Version 11.0 FINAL Rev Asamarendra paridaNo ratings yet

- Inquiries For OngDocument2 pagesInquiries For OngSurianshah shahNo ratings yet

- SubhakantaSwain - Q2 Plan Vs AchivementsDocument4 pagesSubhakantaSwain - Q2 Plan Vs AchivementsSubhakanta SwainNo ratings yet

- Quality Weekly Report: Week Ending July 16, 2021Document17 pagesQuality Weekly Report: Week Ending July 16, 2021ResearcherNo ratings yet

- BSL PDFDocument50 pagesBSL PDFkundanlaNo ratings yet

- Inquiries For OngDocument2 pagesInquiries For OngSurianshah shahNo ratings yet

- Embankment Materail Submission Statut (New) 11-9-08Document8 pagesEmbankment Materail Submission Statut (New) 11-9-08worapol unyaNo ratings yet

- Inquiries For Ongoing Projects: Status As of 1 September 2017Document2 pagesInquiries For Ongoing Projects: Status As of 1 September 2017Surianshah shahNo ratings yet

- Form-Asset Mine Survey (2022)Document2 pagesForm-Asset Mine Survey (2022)Andy Dwi SaputraNo ratings yet

- Monthly Meeting With AMW-2018-03-12Document9 pagesMonthly Meeting With AMW-2018-03-12GalkandaNo ratings yet

- Record Notes of Discussions of MRM Fort The Project "Replacement of Damaged Chequered Plates of B&S Asset On LSTK Basis"Document2 pagesRecord Notes of Discussions of MRM Fort The Project "Replacement of Damaged Chequered Plates of B&S Asset On LSTK Basis"Prathamesh OmtechNo ratings yet

- 1 en TWG2 Secretariat PPT 27oct 1Document14 pages1 en TWG2 Secretariat PPT 27oct 1canquoctuankNo ratings yet

- 2020-01-30-MOM Fire SafetyDocument2 pages2020-01-30-MOM Fire Safetypradeep kumarNo ratings yet

- Inquiries For Ongoing Projects - 2018-01-05Document2 pagesInquiries For Ongoing Projects - 2018-01-05Surianshah shahNo ratings yet

- Minutes Internal MeetingDocument2 pagesMinutes Internal MeetingNur Marini Nabilah MazlanNo ratings yet

- Inquiries For Ong10-20Document2 pagesInquiries For Ong10-20Surianshah shahNo ratings yet

- NCB Training Calendar 2018-19Document8 pagesNCB Training Calendar 2018-19Gaurav ChughNo ratings yet

- Project Status Review VFDocument30 pagesProject Status Review VFJimmy TrujilloNo ratings yet

- 18 Feb 2011 EPC2 Weekly ReportDocument7 pages18 Feb 2011 EPC2 Weekly ReportMarkyNo ratings yet

- Check List Minma Oxygen Plant-26.7.23Document2 pagesCheck List Minma Oxygen Plant-26.7.23Poojaashish TripathiNo ratings yet

- Inquiries For Ongoing Projects: Status As of 4 August 2017Document2 pagesInquiries For Ongoing Projects: Status As of 4 August 2017Surianshah shahNo ratings yet

- Cheah Yi Ben, Benjamin Outstanding WorksDocument8 pagesCheah Yi Ben, Benjamin Outstanding WorksChee Kien LeeNo ratings yet

- Subcontract Schedule (Actual Vs Scheduled)Document2 pagesSubcontract Schedule (Actual Vs Scheduled)EricNo ratings yet

- SC Weekly Report PBDocument29 pagesSC Weekly Report PBMohd AzwanNo ratings yet

- 2authorities Approval Schedule Rev. 01Document1 page2authorities Approval Schedule Rev. 01Yeu ZhiNo ratings yet

- Year 11 B Week 2Document1 pageYear 11 B Week 2kingmannan2008No ratings yet

- Case Studies Compilation Nov 2023Document733 pagesCase Studies Compilation Nov 2023ruturajsawant2799No ratings yet

- 2022 06 27 - EdeDocument2 pages2022 06 27 - EdeDestha IsmiNo ratings yet

- Project Status Report - COM - Oct2021Document5 pagesProject Status Report - COM - Oct2021Parasaram SrinivasNo ratings yet

- 02.13-02.17 - Sales Activity Report (Vivi)Document2 pages02.13-02.17 - Sales Activity Report (Vivi)ptsoutherntristar0No ratings yet

- TR Material - 48537Document2 pagesTR Material - 48537debashree singhNo ratings yet

- D Diiv VA A E EV VA A: N NK K - S SH Hiip PS SDocument17 pagesD Diiv VA A E EV VA A: N NK K - S SH Hiip PS Sangga andi ardiansyahNo ratings yet

- Notes of Meeting (Continuation Sheet)Document6 pagesNotes of Meeting (Continuation Sheet)Vinsentius SuryaNo ratings yet

- MMS For Chaman-FinalDocument17 pagesMMS For Chaman-Finalwaqas khanNo ratings yet

- Book 1Document1 pageBook 1rambala123No ratings yet

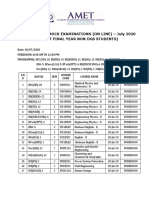

- Mock Exam Time Table JUly 2020Document4 pagesMock Exam Time Table JUly 2020Bharath RamNo ratings yet

- Project Status Report - COM - Jan2022Document4 pagesProject Status Report - COM - Jan2022Parasaram SrinivasNo ratings yet

- Task2 Silo Geometry ModelDocument5 pagesTask2 Silo Geometry Modelshinta theresiaNo ratings yet

- One Week Look A Head PlanDocument1 pageOne Week Look A Head PlankapsarcNo ratings yet

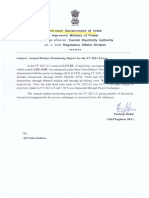

- Annual Market Monitoring Report 2021 - 22, CEADocument91 pagesAnnual Market Monitoring Report 2021 - 22, CEAharshita.sawarna7No ratings yet

- Satellite Communication (EC-812-F) Session PlanDocument3 pagesSatellite Communication (EC-812-F) Session PlanBindia HandaNo ratings yet

- Week 5Document1 pageWeek 5api-261372832No ratings yet

- MOM Weekly QC PP EPC - QC JO 23 Jan 2023Document2 pagesMOM Weekly QC PP EPC - QC JO 23 Jan 2023eko ariyantoNo ratings yet

- Inquiries For Ongoing Projects: Status As of 1 August 2017Document2 pagesInquiries For Ongoing Projects: Status As of 1 August 2017Surianshah shahNo ratings yet

- AfriTin 20220426 p2 PEA.02Document4 pagesAfriTin 20220426 p2 PEA.02Rodrigo RodrigoNo ratings yet

- Port Klang Power Station ProjectDocument19 pagesPort Klang Power Station ProjectOriteNo ratings yet

- Discussion Project, Shipment, Spare Parts (For Maintenance)Document2 pagesDiscussion Project, Shipment, Spare Parts (For Maintenance)Abednedju WowilingNo ratings yet

- F2F Meeting Oct '22 (Sales)Document1 pageF2F Meeting Oct '22 (Sales)aji widiatmokoNo ratings yet

- Face To Face Meeting - August 2020 (Sales)Document286 pagesFace To Face Meeting - August 2020 (Sales)aji widiatmokoNo ratings yet

- F2F Meeting Sep '22 (Sales)Document11 pagesF2F Meeting Sep '22 (Sales)aji widiatmokoNo ratings yet

- Face To Face Meeting - May 2020 (Sales)Document1 pageFace To Face Meeting - May 2020 (Sales)aji widiatmokoNo ratings yet

- Design Thinking ReportDocument2 pagesDesign Thinking ReportAvadhprasad PandeNo ratings yet

- CBP's Side-by-Side Comparison of FTA'sDocument40 pagesCBP's Side-by-Side Comparison of FTA'sYamilet TorresNo ratings yet

- Chinese Enterprise's Overseas Development A Case Study of Haier and TCLDocument0 pagesChinese Enterprise's Overseas Development A Case Study of Haier and TCLkarandeep19854645No ratings yet

- Financial Accounting IIDocument96 pagesFinancial Accounting IITuryamureeba Julius100% (1)

- Kolhapuri ChappalsDocument30 pagesKolhapuri ChappalsPriyanka TrivediNo ratings yet

- Activity 3Document3 pagesActivity 3EllieNo ratings yet

- Chapter 7 Elasticity of SupplyDocument4 pagesChapter 7 Elasticity of SupplyAmmaar KIMTINo ratings yet

- CADocument72 pagesCAGeorge Mitchell S. Guerrero100% (1)

- MarchDocument7 pagesMarchRohama TullaNo ratings yet

- 3 RetrieveDocument11 pages3 RetrieveayushiNo ratings yet

- "Financial System Manual of R.K. Marble": (H.R.Manager) MBA Semester IIDocument63 pages"Financial System Manual of R.K. Marble": (H.R.Manager) MBA Semester IIsalujass100% (1)

- Quiz #2Document10 pagesQuiz #2Kheianne DaveighNo ratings yet

- Report On NCCBL, Jubilee Road BrunchDocument64 pagesReport On NCCBL, Jubilee Road BrunchNiaz MorshedNo ratings yet

- 45 Important SAP PP Interview Questions Answers Set 1 - CareersLiteDocument34 pages45 Important SAP PP Interview Questions Answers Set 1 - CareersLiterushikeshdeokar155No ratings yet

- Construction of IndexDocument13 pagesConstruction of IndexNishi SharmaNo ratings yet

- Disruptive Energy BrochureDocument10 pagesDisruptive Energy BrochureCody JacksonNo ratings yet

- Johnson & JohnsonDocument130 pagesJohnson & Johnsontyg1992No ratings yet

- Zipcar 1&2Document6 pagesZipcar 1&2Gaurav Singh ੴ0% (1)

- TCS WaqasDocument19 pagesTCS WaqasRehan Akram50% (2)

- 5P's in Portfolio ManagementDocument2 pages5P's in Portfolio ManagementMeyannaNo ratings yet

- Special Topics in Operation ManagementDocument7 pagesSpecial Topics in Operation ManagementElvis Pahigo MarataNo ratings yet

- RBA APU PPT - OJK 16 April 2018 PDFDocument46 pagesRBA APU PPT - OJK 16 April 2018 PDFBunnyNo ratings yet

- Group Members:: Comparison Between Bank AL Habib & Habib Metro BankDocument13 pagesGroup Members:: Comparison Between Bank AL Habib & Habib Metro BankAbbas AliNo ratings yet

- Ita Imia 2023 BDDocument28 pagesIta Imia 2023 BDKishor YenepalliNo ratings yet

- Chap 025Document26 pagesChap 025latifa hnNo ratings yet

- Capital Expenditure & Revenue Expenditure ExerciseDocument21 pagesCapital Expenditure & Revenue Expenditure ExerciseASMARA HABIBNo ratings yet

- Best Practice of Science / Technology Parks: Factors For Science Park PlanningDocument12 pagesBest Practice of Science / Technology Parks: Factors For Science Park PlanningErmawaty MaradhyNo ratings yet

- Book Reviews: I.M. Pandey (Ed.), Financial Management, Eleventh ISBN: 978-8125937142 (Paperback)Document2 pagesBook Reviews: I.M. Pandey (Ed.), Financial Management, Eleventh ISBN: 978-8125937142 (Paperback)ihda0farhatun0nisakNo ratings yet