Professional Documents

Culture Documents

S& P 500 Update 2 May 10

Uploaded by

AndysTechnicalsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

S& P 500 Update 2 May 10

Uploaded by

AndysTechnicalsCopyright:

Available Formats

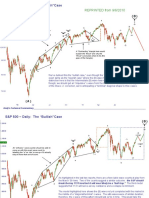

S&P 500 Daily and Weekly Candlesticks

The daily and weekly candlesticks have been providing false signals the last couple of weeks. The current weekly candle is 100% bearish.

It’s an “engulfing” pattern, meaning that anyone who “bought the dip” the last three weeks is underwater. The daily candlestick to end the

week is also ugly bearish. Additionally, a “broadening top” formation is evident, which may explain the unreliability of the recent

candlesticks and the heavy volume on both up and down days.

“Broadening Top”

Daily

The classic technical analysis text by Edwards and Magee characterizes a broadening

top as a market that lacks intelligent sponsorship. It is one in which the public is being

whipped around and driven this way and that by rumors. As such, volume during the

broadening top pattern tends to be irregular. During some rallies volume may expand,

but during others it tends to be tepid. The same pattern applies on pullbacks. Because it

is so unpredictable, the broadening top pattern is extremely difficult to trade. There is no

clear breakout to either the upside or downside edge of the pattern. Weekly

Andy’s Technical Commentary__________________________________________________________________________________________________

S&P 500 Weekly with the 8,13 and 55 week EMA

Using the longer term Fibonacci EMAs, bulls have nothing to be concerned

about. Alas, this is one of the of the pitfalls of “moving average” technical

analysis: it does a good job keeping one “in a trend,” but there’s a tendency

to give money back at the turns. It would probably take a break of 1084 to

trigger a trend reversal here.

“Funny” how the market has been struggling

in front of the 61.8% retrace. Someone has

been placing plenty of sell orders in front of

this very well known retracement level. 55 Week EMA holds twice

8/13

bullish

cross

Andy’s Technical Commentary__________________________________________________________________________________________________

c “y”

S&P 500 June e-Minis ~ (300 min.) a e

d

b

b d

g

“x”

“w” e

c

-5-

c This overlapping price action in the middle of

the progression highly suggests the

a presence of a corrective “x” wave

-3-

a

-1- -4-

The “y” wave appears to have completed with a ‘neutral triangle’ pattern,

which is a triangle that tends to “bulge” in the middle and end with an e-wave

-2- that ends up not gaining or losing much ground with the a-wave termination

point. Basically, it’s a triangle that neither “contracts” nor “expands.”

b

(X)

Andy’s Technical Commentary__________________________________________________________________________________________________

Head

S&P 500 June e-Minis ~ (60 min.) c

-c-

“y”

Left Shoulder a e Right

-c- -a- 1208 Shoulder

-a-

-b- -b-

d

b

1176.75

d

b g

Maybe we get a more “complex”

“x” right shoulder to give better

e symmetry to this formation.

All of the action in the last few weeks looks like a “topping formation.” Given this

model, 1208 would have to be considered key resistance. There also appears to be a

“head and shoulders” top in play. 1176.75 looks like classic chart support for bulls, but

c the slanted “neckline” could also be considered some support. The whole picture

looks bearish right now and would become even more so on a break of the neckline

(green-dashed line). Bears should consider 1208 as a “stop” on the June futures.

Andy’s Technical Commentary__________________________________________________________________________________________________

-X-

S&P 500 Daily ~ A “Triple” Finally Concluded? (Z)

(Y) “y”?

“y”

c “w”

“w” a “x”

g

e

b

c

a (X)

1034

f

d

“x”

(W)

b

869

(X)

This would have to be the model that finished the entire advance from the 667 lows. Because

of how treacherous it has been attempting to call “the top,” I won’t do so now. However, given

the time of the year (“Sell in May and Go Away”) and the fact that this market has rallied so

unrelentingly, it would seem to be ripe for at least a robust correction.

667

-W-

Andy’s Technical Commentary__________________________________________________________________________________________________

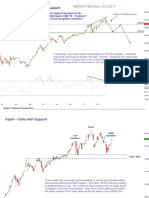

S&P 500 Weekly - Alternative

This would be alternative count. It’s taken from the conclusions that Glenn Neely

has reached. Essentially it calls for more time before the Primary - B - wave

< B >? finally concludes. He would probably be the first to admit, though, that the “a”

wave high might not be bettered during the (Y) wave. I still have some doubts

about this model: I don’t like how big the “e” wave is within (W) and I don’t like

741 as the conclusion of the pattern lower. However, Neely makes a lot more

< B >? money than me and he’s been doing it a lot longer, so who am I to argue?

-B-

(Y)

“a” “c”

(W)

“e”

“b”

“a” “c” (X)

“d”

In practical terms, this count and the one on the

741 previous page are actually not very different.

-A-

“b”

Andy’s Technical Commentary__________________________________________________________________________________________________

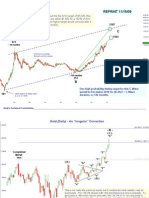

Euro (June Futures) Daily with Commitment of Traders

I don’t really have a good wave count for the Euro. However, the recent

Commitment of Traders shows an extremely high level of speculative shorts as all

the world is now convinced the Euro is “going to unravel.” The Euro may very well

dissolve as a currency someday, but perhaps we’re due for some sort of bounce in

order to wash out all the new speculative shorts. The descent of the Euro in recent

weeks is not too impressive as it appears to be “grinding” lower, not “impulsing.”

All of this looks “congestive”

Andy’s Technical Commentary__________________________________________________________________________________________________

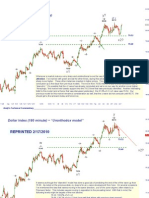

S&P 500 Daily (Log Scale) ~ An On Going “Triple” (Z)

1219?

(Y)

(X)

(W)

Reprinted from 3/13/10

(X)

In support of the idea of an ongoing “Triple,” it’s possible to draw a perfect trend channel that connects

the (X) waves with the (W) and (Y) end points.

Andy’s Technical Commentary__________________________________________________________________________________________________

DISCLAIMER WARNING DISCLAIMER WARNING DISCLAIMER

This report should not be interpreted as investment advice of any

kind. This report is technical commentary only. The author is Wave Symbology

NOT representing himself as a CTA or CFA or Investment/Trading

Advisor of any kind. This merely reflects the author’s "I" or "A" = Grand Supercycle

interpretation of technical analysis. The author may or may not I or A = Supercycle

trade in the markets discussed. The author may hold positions <I>or <A> = Cycle

opposite of what may by inferred by this report. The information -I- or -A- = Primary

contained in this commentary is taken from sources the author (I) or (A) = Intermediate

believes to be reliable, but it is not guaranteed by the author as to "1“ or "a" = Minor

the accuracy or completeness thereof and is sent to you for 1 or a = Minute

information purposes only. Commodity trading involves risk and -1- or -a- = Minuette

is not for everyone. (1) or (a) = Sub-minuette

[1] or [a] = Micro

Here is what the Commodity Futures Trading Commission (CFTC) [.1] or [.a] = Sub-Micro

has said about futures trading: Trading commodity futures and

options is not for everyone. IT IS A VOLATILE, COMPLEX AND

RISKY BUSINESS. Before you invest any money in futures or

options contracts, you should consider your financial experience,

goals and financial resources, and know how much you can afford

to lose above and beyond your initial payment to a broker. You

should understand commodity futures and options contracts and

your obligations in entering into those contracts. You should

understand your exposure to risk and other aspects of trading by

thoroughly reviewing the risk disclosure documents your broker is

required to give you.

You might also like

- John F Carter - How I Trade FoDocument259 pagesJohn F Carter - How I Trade FoEma Em87% (15)

- Day Trading With Pivot Points & Price Aaction Vikram PrabhuDocument104 pagesDay Trading With Pivot Points & Price Aaction Vikram PrabhuAshish Singh100% (3)

- Technical AnalysisDocument19 pagesTechnical AnalysisManas Maheshwari100% (1)

- Simplify Your Trading With The 2-Period RSIDocument5 pagesSimplify Your Trading With The 2-Period RSImhudzz50% (2)

- D Ifta Journal 00Document48 pagesD Ifta Journal 00dan397100% (1)

- What Is A Doji Candlestick PatternDocument6 pagesWhat Is A Doji Candlestick Patternsarped10No ratings yet

- Forex Trading Bootcamp Day 5 - Imbalance, Liquidity and Indicator Based StrategiesDocument46 pagesForex Trading Bootcamp Day 5 - Imbalance, Liquidity and Indicator Based StrategiesArrow Builders100% (3)

- The Wolf - Strategy PDFDocument6 pagesThe Wolf - Strategy PDFSiva Sangari100% (1)

- REPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartDocument8 pagesREPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartAndysTechnicalsNo ratings yet

- S&P 500 Update 25 Apr 10Document7 pagesS&P 500 Update 25 Apr 10AndysTechnicalsNo ratings yet

- Market Update 21 Nov 10Document10 pagesMarket Update 21 Nov 10AndysTechnicalsNo ratings yet

- Market Commentary 13mar11Document8 pagesMarket Commentary 13mar11AndysTechnicalsNo ratings yet

- REPRINTED From 9/12/2010: S&P 500 Daily: The "Bearish"CaseDocument8 pagesREPRINTED From 9/12/2010: S&P 500 Daily: The "Bearish"CaseAndysTechnicalsNo ratings yet

- S&P 500 Update 18 Apr 10Document10 pagesS&P 500 Update 18 Apr 10AndysTechnicalsNo ratings yet

- REPRINTED From 9/7/2010:: S&P 500 Daily: The "Bullish"CaseDocument7 pagesREPRINTED From 9/7/2010:: S&P 500 Daily: The "Bullish"CaseAndysTechnicalsNo ratings yet

- Dollar Index (180 Minute) "Unorthodox Model"Document6 pagesDollar Index (180 Minute) "Unorthodox Model"AndysTechnicalsNo ratings yet

- Dollar Index 15 Feb 2010Document4 pagesDollar Index 15 Feb 2010AndysTechnicalsNo ratings yet

- SP500 Update 13 June 10Document9 pagesSP500 Update 13 June 10AndysTechnicalsNo ratings yet

- Market Update 11 July 10Document13 pagesMarket Update 11 July 10AndysTechnicalsNo ratings yet

- S&P 500 Update 4 Apr 10Document10 pagesS&P 500 Update 4 Apr 10AndysTechnicalsNo ratings yet

- Morning View 12feb2010Document8 pagesMorning View 12feb2010AndysTechnicalsNo ratings yet

- DXY Report 11 April 2010Document8 pagesDXY Report 11 April 2010AndysTechnicalsNo ratings yet

- Market Commentary 21feb11Document10 pagesMarket Commentary 21feb11AndysTechnicalsNo ratings yet

- S&P 500 Update 2 Jan 10Document8 pagesS&P 500 Update 2 Jan 10AndysTechnicalsNo ratings yet

- Gold Report 29 Nov 2009Document11 pagesGold Report 29 Nov 2009AndysTechnicalsNo ratings yet

- Market Discussion 19 Dec 10Document6 pagesMarket Discussion 19 Dec 10AndysTechnicalsNo ratings yet

- Unorthodox Corrections & Weird Fractals & SP500 ImplicationsDocument8 pagesUnorthodox Corrections & Weird Fractals & SP500 ImplicationsAndysTechnicals100% (1)

- Market Update 28 Nov 10Document8 pagesMarket Update 28 Nov 10AndysTechnicalsNo ratings yet

- Market Commentary 27mar11Document10 pagesMarket Commentary 27mar11AndysTechnicalsNo ratings yet

- S&P 500 Update 9 Nov 09Document6 pagesS&P 500 Update 9 Nov 09AndysTechnicalsNo ratings yet

- Market Discussion 12 Dec 10Document9 pagesMarket Discussion 12 Dec 10AndysTechnicalsNo ratings yet

- Market Discussion 5 Dec 10Document9 pagesMarket Discussion 5 Dec 10AndysTechnicalsNo ratings yet

- S&P 500 Daily: The "Double Top Count"Document7 pagesS&P 500 Daily: The "Double Top Count"AndysTechnicalsNo ratings yet

- Morning View 27jan2010Document6 pagesMorning View 27jan2010AndysTechnicals100% (1)

- S&P 500 Daily: The "Bullish"Case: REPRINTED From 9/6/2010Document10 pagesS&P 500 Daily: The "Bullish"Case: REPRINTED From 9/6/2010AndysTechnicalsNo ratings yet

- Market Update 27 June 10Document9 pagesMarket Update 27 June 10AndysTechnicalsNo ratings yet

- Market Commentary 10apr11Document12 pagesMarket Commentary 10apr11AndysTechnicalsNo ratings yet

- Market Update 18 July 10Document10 pagesMarket Update 18 July 10AndysTechnicalsNo ratings yet

- Gold Report 7 Nov 2010Document8 pagesGold Report 7 Nov 2010AndysTechnicalsNo ratings yet

- Morning View 18 Feb 10Document6 pagesMorning View 18 Feb 10AndysTechnicalsNo ratings yet

- SP500 Update 31 May 10Document13 pagesSP500 Update 31 May 10AndysTechnicalsNo ratings yet

- Market Commentary 11mar12Document7 pagesMarket Commentary 11mar12AndysTechnicalsNo ratings yet

- Sugar Nov 28 2009Document9 pagesSugar Nov 28 2009AndysTechnicalsNo ratings yet

- Morning Update 3 Mar 10Document5 pagesMorning Update 3 Mar 10AndysTechnicalsNo ratings yet

- Gold Report 15 Nov 2009Document11 pagesGold Report 15 Nov 2009AndysTechnicalsNo ratings yet

- Morning View 10feb2010Document8 pagesMorning View 10feb2010AndysTechnicalsNo ratings yet

- Gold Report 12 Sep 2010Document16 pagesGold Report 12 Sep 2010AndysTechnicalsNo ratings yet

- Sp500 Update 5sep11Document7 pagesSp500 Update 5sep11AndysTechnicalsNo ratings yet

- SP500 Update 22 Aug 10Document7 pagesSP500 Update 22 Aug 10AndysTechnicalsNo ratings yet

- Market Commentary 1JUL12Document8 pagesMarket Commentary 1JUL12AndysTechnicalsNo ratings yet

- Morning View 19 Feb 10Document4 pagesMorning View 19 Feb 10AndysTechnicalsNo ratings yet

- S&P 500 Update 20 Dec 09Document10 pagesS&P 500 Update 20 Dec 09AndysTechnicalsNo ratings yet

- Sp500 Update 23oct11Document7 pagesSp500 Update 23oct11AndysTechnicalsNo ratings yet

- Gold Report 16 May 2010Document11 pagesGold Report 16 May 2010AndysTechnicalsNo ratings yet

- SP500 Update 2 Jan 11Document9 pagesSP500 Update 2 Jan 11AndysTechnicalsNo ratings yet

- Market Update 25 July 10Document13 pagesMarket Update 25 July 10AndysTechnicalsNo ratings yet

- Offers: Protection Circuit ProtectionDocument5 pagesOffers: Protection Circuit ProtectionGdfjjNo ratings yet

- Gold Update 2 Nov 09Document4 pagesGold Update 2 Nov 09AndysTechnicalsNo ratings yet

- Wednesday Update 10 March 2010Document6 pagesWednesday Update 10 March 2010AndysTechnicalsNo ratings yet

- Edelweiss: Tablature - Accordéon Diatonique - CmajDocument1 pageEdelweiss: Tablature - Accordéon Diatonique - CmajEwka KonewkaNo ratings yet

- Market Commentary 25SEP11Document8 pagesMarket Commentary 25SEP11AndysTechnicalsNo ratings yet

- VW Golf IVDocument113 pagesVW Golf IVSavo Jokanovic50% (2)

- Market Commentary 27NOV11Document5 pagesMarket Commentary 27NOV11AndysTechnicalsNo ratings yet

- S&P 500 (180 Min.) : Key Resistance Points Remain 1078 and 1100Document7 pagesS&P 500 (180 Min.) : Key Resistance Points Remain 1078 and 1100AndysTechnicalsNo ratings yet

- +2 Unit 8 Combo TMDocument27 pages+2 Unit 8 Combo TMKeerthana EasunathanNo ratings yet

- DeWalt DC542 Glue GunDocument176 pagesDeWalt DC542 Glue GunNikos Antreas PapanikolaouNo ratings yet

- Geometry. Lines and Angles. Angles On Parallel Lines ADocument1 pageGeometry. Lines and Angles. Angles On Parallel Lines ADena KaranNo ratings yet

- Market Commentary 29apr12Document6 pagesMarket Commentary 29apr12AndysTechnicalsNo ratings yet

- Market Commentary 22JUL12Document6 pagesMarket Commentary 22JUL12AndysTechnicalsNo ratings yet

- Market Commentary 1JUL12Document8 pagesMarket Commentary 1JUL12AndysTechnicalsNo ratings yet

- Market Commentary 5aug12Document7 pagesMarket Commentary 5aug12AndysTechnicalsNo ratings yet

- Market Commentary 17JUN12Document7 pagesMarket Commentary 17JUN12AndysTechnicalsNo ratings yet

- S&P500 Report 22apr12Document12 pagesS&P500 Report 22apr12AndysTechnicalsNo ratings yet

- S&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportDocument6 pagesS&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportAndysTechnicals100% (1)

- Market Commentary 10JUN12Document7 pagesMarket Commentary 10JUN12AndysTechnicalsNo ratings yet

- Market Commentary 20may12Document7 pagesMarket Commentary 20may12AndysTechnicalsNo ratings yet

- S&P 500 Commentary 12feb12Document6 pagesS&P 500 Commentary 12feb12AndysTechnicalsNo ratings yet

- Market Commentary 1apr12Document8 pagesMarket Commentary 1apr12AndysTechnicalsNo ratings yet

- Market Commentary 25mar12Document8 pagesMarket Commentary 25mar12AndysTechnicalsNo ratings yet

- Market Commentary 18mar12Document8 pagesMarket Commentary 18mar12AndysTechnicalsNo ratings yet

- Market Commentary 11mar12Document7 pagesMarket Commentary 11mar12AndysTechnicalsNo ratings yet

- Market Commentary 26feb12Document6 pagesMarket Commentary 26feb12AndysTechnicalsNo ratings yet

- Dollar Index (DXY) Daily ContinuationDocument6 pagesDollar Index (DXY) Daily ContinuationAndysTechnicalsNo ratings yet

- S& P 500 Commentary 20feb12Document9 pagesS& P 500 Commentary 20feb12AndysTechnicalsNo ratings yet

- Market Commentary 20NOV11Document7 pagesMarket Commentary 20NOV11AndysTechnicalsNo ratings yet

- Market Commentary 29jan12Document6 pagesMarket Commentary 29jan12AndysTechnicalsNo ratings yet

- Market Commentary 8jan12Document8 pagesMarket Commentary 8jan12AndysTechnicalsNo ratings yet

- Market Commentary 16jan12Document7 pagesMarket Commentary 16jan12AndysTechnicalsNo ratings yet

- Market Commentary 22jan12Document8 pagesMarket Commentary 22jan12AndysTechnicalsNo ratings yet

- Copper Commentary 11dec11Document6 pagesCopper Commentary 11dec11AndysTechnicalsNo ratings yet

- Market Commentary 2jan12Document7 pagesMarket Commentary 2jan12AndysTechnicalsNo ratings yet

- Market Commentary 27NOV11Document5 pagesMarket Commentary 27NOV11AndysTechnicalsNo ratings yet

- Market Commentary 6NOVT11Document4 pagesMarket Commentary 6NOVT11AndysTechnicalsNo ratings yet

- Market Commentary 19DEC11Document9 pagesMarket Commentary 19DEC11AndysTechnicals100% (1)

- Market Commentary 30OCT11Document6 pagesMarket Commentary 30OCT11AndysTechnicalsNo ratings yet

- Copper Commentary 2OCT11Document8 pagesCopper Commentary 2OCT11AndysTechnicalsNo ratings yet

- Sp500 Update 23oct11Document7 pagesSp500 Update 23oct11AndysTechnicalsNo ratings yet

- Candle TermDocument3 pagesCandle Termlector_961No ratings yet

- Understanding Price Gaps and Their ImplicationsDocument4 pagesUnderstanding Price Gaps and Their ImplicationssatishdinakarNo ratings yet

- Choosing Options Strategy Guide PDFDocument19 pagesChoosing Options Strategy Guide PDFJeffNo ratings yet

- TD SystemDocument23 pagesTD Systemmoluguru100% (1)

- Technical Analysis For Options TradingDocument15 pagesTechnical Analysis For Options Tradingpankaj thakurNo ratings yet

- 9D Research GroupDocument9 pages9D Research Groupapi-291828723No ratings yet

- Teach A Man How To FishDocument9 pagesTeach A Man How To FishRonak SinghNo ratings yet

- Speculation: The Art of Speculation Mutual FundsDocument2 pagesSpeculation: The Art of Speculation Mutual Fundssan291076No ratings yet

- Macd PDFDocument15 pagesMacd PDFsaran21No ratings yet

- Wicktator Trade Material - Paul SDocument47 pagesWicktator Trade Material - Paul SrontechtipsNo ratings yet

- Trading ABCD PatternDocument8 pagesTrading ABCD PatternHassan KNo ratings yet

- Ch2 Understanding Supply & DemandDocument18 pagesCh2 Understanding Supply & DemandAbdul RachmanNo ratings yet

- How I Orginize My DeskDocument1 pageHow I Orginize My DeskMaxamed CabddiNo ratings yet

- Reading Price & Volume Across Multiple Timeframes - Dr. Gary DaytonDocument7 pagesReading Price & Volume Across Multiple Timeframes - Dr. Gary Daytonmr1232375% (8)

- Candlestick PatternDocument9 pagesCandlestick PatternMuhamad ZaqquanNo ratings yet

- Profitable Candlestick PatternsDocument53 pagesProfitable Candlestick Patternsaan_pkppk88% (17)

- Candlestickv2 3Document1 pageCandlestickv2 3Shahril ZainuddinNo ratings yet

- FTSE ASEAN 40 Index: Thriving in Time of Volatility: Regional Traders' AlmanacDocument11 pagesFTSE ASEAN 40 Index: Thriving in Time of Volatility: Regional Traders' Almanacmohd azraieNo ratings yet

- Chris Lewis The Day Trader's GuiDocument299 pagesChris Lewis The Day Trader's Guinanda kumarNo ratings yet

- Bearish Bets 3 Stocks You Really Should Think About Shorting This WeekDocument6 pagesBearish Bets 3 Stocks You Really Should Think About Shorting This WeekhanvwbNo ratings yet

- 2010 Ilia-Bermous Candlepatterns PDFDocument21 pages2010 Ilia-Bermous Candlepatterns PDFGemilang Suryadi RNo ratings yet

- Forex Earth Sky Trading SystemDocument82 pagesForex Earth Sky Trading SystemShawal Abu SamahNo ratings yet