Professional Documents

Culture Documents

Explica La Diferència Que Hi Ha Entre Les Cotitzacions A La Seguretat Social I Les Retencions de l'IRPF.

Uploaded by

Precious Omogbai0 ratings0% found this document useful (0 votes)

40 views3 pagesEconomia

Original Title

Explica La Diferència Que Hi Ha Entre Les Cotitzacions a La Seguretat Social i Les Retencions de l’IRPF.

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentEconomia

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

40 views3 pagesExplica La Diferència Que Hi Ha Entre Les Cotitzacions A La Seguretat Social I Les Retencions de l'IRPF.

Uploaded by

Precious OmogbaiEconomia

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

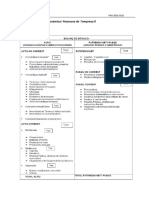

Explica la diferència que hi ha entre les cotitzacions a la Seguretat

Social i les retencions de l’IRPF.

Introducció: El concepte de cotitzacions i retencions

En aquesta societat moderna i complexa, l'economia és un tema clau que afecta tothom. Per tant, és

important comprendre el concepte de cotitzacions i retencions dins del sistema fiscal i de seguretat social

espanyol. Les cotitzacions són les quantitats de diners que es paguen a la Seguretat Social, les quals

s'utilitzen per finançar les prestacions socials que ofereix l'Estat. D'altra banda, les retencions de l'IRPF

són les quantitats de diners que es dedueixen del salari per a ser entregades a l'Agència Tributària, així

garantint el pagament dels impostos corresponents. Tot i que a simple vista sembla que són conceptes

similars, en realitat són diferents, ja que cada un té una funció específica dins del sistema fiscal i de

seguretat social, i per tant, esdevé important distingir aquestes dues aportacions econòmiques.

2. Cotitzacions a la Seguretat Social: Definició i càlcul

Seguint amb el tema de les cotitzacions a la Seguretat Social, és important tenir en compte que aquestes

són les aportacions que fan els treballadors i les empreses a l'estat per tenir dret a diferents prestacions,

com ara les pensions de jubilació, les baixes per malaltia o les prestacions per atur. És important fer

menció que el càlcul d'aquestes cotitzacions es realitza en funció del salari brut del treballador, aplicant

una sèrie de percentatges que varien en funció de la base de cotització. Cal destacar que aquesta base

s'obté aplicant uns límits màxims i mínims al salari del treballador, de manera que això limita la quantitat

màxima que es pot arribar a cotitzar en un mes. En resum, les cotitzacions a la Seguretat Social són una

obligació per als treballadors i les empreses per tenir accés a les prestacions de la Seguretat Social i el

seu càlcul depèn dels ingressos del treballador.

3. Retencions de l’IRPF: Què són i com es calculen?

Retencions de l’IRPF, or income tax withholdings, are amounts of money that employers deduct from

employees’ paychecks and remit to the government to satisfy tax obligations. The amount of money with-

held depends on several factors, including the employee’s income level, tax bracket, and the withholding

allowances claimed on the W-4 form. The withholding amount is calculated by determining the taxable

income and applying the tax rate for the employee’s bracket. These withholdings serve as an estimate of

the employee’s annual tax liability and are reconciled when the employee files their income tax return. It

is important to note that despite a common misconception, the amount of income tax withheld does not

necessarily equate to the total amount of income tax owed for the year.

4. Diferències principals entre cotitzacions i retencions

There are several key differences between social security contributions and income tax withholdings,

which are important to understand in order to properly manage one's finances. Firstly, social security

contributions are mandatory payments made by both employers and employees in order to fund govern-

ment-run social programs, such as healthcare, pensions, and unemployment benefits. These contributions

are calculated as a percentage of an employee's salary, and the specific rate may vary based on factors

such as income level and employment status. On the other hand, income tax withholdings are deductions

made by an employer from an employee's pay, which are then transferred to the government to cover

federal and state income taxes owed by the employee. These withholdings may also be calculated as

a percentage of an employee's salary, but the rate is determined by a variety of factors, including the

employee's filing status, exemptions, and deductions. Additionally, unlike social security contributions,

income tax withholdings are not a fixed amount, but rather may vary based on changes in the employee's

taxable income throughout the year.

5. Conclusió: La importància de comprendre les diferències entre cotitzacions i retencions.

In conclusion, it is crucial to understand the differences between social security contributions and

income tax withholdings. These two concepts are often misunderstood and used interchangeably, causing

confusion among individuals and organizations. Social security contributions are mandatory payments

made by employees and employers to ensure access to public healthcare, pensions, and unemployment

benefits. On the other hand, income tax withholdings are amounts withheld from an individual's salary

to meet their annual income tax obligation. Knowing the difference between the two is essential in

identifying the portion of one's salary deducted for social security and taxes. This information is vital in

developing comprehensive financial plans and ensuring compliance with relevant laws and regulations.

Understanding the nuances of social security contributions and income tax withholdings is critical for

navigating the complex landscape of personal finance and taxation.

Bibliography

This essay was written by Samwell AI.

https://samwell.ai

You might also like

- Pràctica PAFDocument648 pagesPràctica PAFOmNo ratings yet

- Actiitats Nòmines - CòpiaDocument1 pageActiitats Nòmines - CòpiaAlbertNo ratings yet

- Fàtima Grouri - Pràctica 1Document5 pagesFàtima Grouri - Pràctica 1Fátima GrouriNo ratings yet

- 2022 Tema 3 La Seguretat SocialDocument48 pages2022 Tema 3 La Seguretat SocialVicente CancioNo ratings yet

- TEMA 5 Act.Document5 pagesTEMA 5 Act.Taniya BhandariNo ratings yet

- AUTONOMOSDocument2 pagesAUTONOMOSj2071712No ratings yet

- Fol - Trimestral 2: Tema 4. El Rebut de Salaris: La NòminaDocument28 pagesFol - Trimestral 2: Tema 4. El Rebut de Salaris: La Nòminau1996082No ratings yet

- Grups I Bases de Cotització - A Quin Pertanyo I Quant Es Paga en CadascunDocument3 pagesGrups I Bases de Cotització - A Quin Pertanyo I Quant Es Paga en CadascunJudit FlorenzaNo ratings yet

- Obligacions de LempresariDocument14 pagesObligacions de Lempresarisergi13coralNo ratings yet

- A1.1 SolucioDocument10 pagesA1.1 Soluciosergi13coralNo ratings yet

- Eco Activitat 9Document3 pagesEco Activitat 9Daniela SorianoNo ratings yet

- Pensions Europa (Andorra, Itàlia, Alemanya I Dinamarca)Document6 pagesPensions Europa (Andorra, Itàlia, Alemanya I Dinamarca)Angelica Tatiana Giraldo CardonaNo ratings yet

- La Seguretat SocialDocument35 pagesLa Seguretat Socialsergi13coralNo ratings yet

- Sol Unidad 08 CAT OARRHH MMDocument39 pagesSol Unidad 08 CAT OARRHH MMRoberto Ruiz TenorioNo ratings yet

- Activitat Educativa Dret Laboral EspanyaDocument5 pagesActivitat Educativa Dret Laboral EspanyaAwa GikinehNo ratings yet

- Tema 6 Exercici 2Document3 pagesTema 6 Exercici 2Isma SidibeNo ratings yet

- Investigació: El Sistema de PensionsDocument3 pagesInvestigació: El Sistema de PensionsJordi Baró ArausNo ratings yet

- Fiscalitat Empresarial AC2 Solucions OrientativesDocument8 pagesFiscalitat Empresarial AC2 Solucions OrientativesyellowaminaNo ratings yet

- Apuntes Completos FinancieroDocument159 pagesApuntes Completos FinancierosuperedishowNo ratings yet

- Unitat 10. Liquidació de Les Cotitzacions Socials I de Les Retencions A Compte de l'IRPFDocument25 pagesUnitat 10. Liquidació de Les Cotitzacions Socials I de Les Retencions A Compte de l'IRPFRoberto Ruiz TenorioNo ratings yet

- Tribu. 1r ExamenDocument37 pagesTribu. 1r ExamenGiulia CarrerasNo ratings yet

- Document Sense TítolDocument3 pagesDocument Sense TítolAlejandra Gamez UrbanoNo ratings yet

- Economia Tema 9Document6 pagesEconomia Tema 9Iker Viñuelas OrmazabalNo ratings yet

- Condicions 2015Document25 pagesCondicions 2015jose salvadorNo ratings yet

- TEMA 5 I 6Document13 pagesTEMA 5 I 6Isaac CortesNo ratings yet

- Tema 6 (2) Política FiscalDocument8 pagesTema 6 (2) Política Fiscaldavid artecheNo ratings yet

- T3 APROVISIONAMENT I VENDES 2 Compres I DespesesDocument18 pagesT3 APROVISIONAMENT I VENDES 2 Compres I DespesesifgbcNo ratings yet

- Document Sense TítolDocument3 pagesDocument Sense TítolAlejandra Gamez UrbanoNo ratings yet

- Pensió de JubilacióDocument11 pagesPensió de JubilacióChaimaNo ratings yet

- Cof PRM 14 CatDocument10 pagesCof PRM 14 CatCristina Del PradoNo ratings yet

- 2 FOL La Jornada Laboral I El SalariDocument8 pages2 FOL La Jornada Laboral I El SalariVerónica RapelaNo ratings yet

- UNITAT 3 EcoDocument10 pagesUNITAT 3 EcoKNIGHTNo ratings yet

- Uf1 NF1 Aea2Document19 pagesUf1 NF1 Aea2Emma Pérez GarcíaNo ratings yet

- PDFDocument20 pagesPDFAnonymous T9pZ8ziZuaNo ratings yet

- ROBERTO RUIZ - VISUAL NF8 I NF9 - CONTRACTESDocument2 pagesROBERTO RUIZ - VISUAL NF8 I NF9 - CONTRACTESRoberto Ruiz TenorioNo ratings yet

- Teoria ComptabilitatDocument3 pagesTeoria Comptabilitatz8sk4pv4qsNo ratings yet

- Examen FolDocument6 pagesExamen FolJenifer Aguilera AgudoNo ratings yet

- Tem 17 Adm 2011Document25 pagesTem 17 Adm 2011DrissNo ratings yet

- U2. Incapacitat TemporalDocument3 pagesU2. Incapacitat TemporalNuriaNo ratings yet

- Fol EjerciciosDocument2 pagesFol EjerciciosMireia NisaNo ratings yet

- Resum Del Full de SalariDocument2 pagesResum Del Full de SalaritxellguillenNo ratings yet

- Tema 7 Compt - Documentos de GoogleDocument5 pagesTema 7 Compt - Documentos de GoogleklplecturasNo ratings yet

- QüestionariDocument1 pageQüestionaridonatogomezjarqueNo ratings yet

- Dossier Tema 2Document18 pagesDossier Tema 2luciaburjassotNo ratings yet

- Fiscalitat de La Renda de Les Persones FísiquesDocument74 pagesFiscalitat de La Renda de Les Persones FísiquesRl XinuNo ratings yet

- Uf1 NF1 Aea1Document13 pagesUf1 NF1 Aea1Emma Pérez GarcíaNo ratings yet

- Llei de L'impost Sobre La Renda de Les Persones FísiquesDocument210 pagesLlei de L'impost Sobre La Renda de Les Persones FísiquesAlbertNo ratings yet

- ExcepcionsDocument5 pagesExcepcionsLaia ReyNo ratings yet

- Tema 4. El Salari I La NòminaDocument17 pagesTema 4. El Salari I La Nòminafury86mscNo ratings yet

- Tema 5 El Sistema de La Seguretat Social-1Document7 pagesTema 5 El Sistema de La Seguretat Social-1MilenneNo ratings yet

- Resum - Pau - Bloc - 1 2a - PartDocument12 pagesResum - Pau - Bloc - 1 2a - PartlbanulsNo ratings yet

- Tema 4Document7 pagesTema 4marinaibamagNo ratings yet

- Resum Incapacitats, Jubilació I AturDocument24 pagesResum Incapacitats, Jubilació I AturAndrea Patricia Armijo RodriguezNo ratings yet

- REPÀS FORMES JURIDIQUES - SandibellzerpavillafranoDocument8 pagesREPÀS FORMES JURIDIQUES - SandibellzerpavillafranoFernanda HuamaniNo ratings yet

- Resum Unitat 2 EconomiaDocument7 pagesResum Unitat 2 EconomiaberenguerbailenNo ratings yet

- M03B1 UF2 TeoriaDocument11 pagesM03B1 UF2 TeoriaMaribel B. B.No ratings yet

- Tema 6. Demanda Agregada. MultiplicadorDocument11 pagesTema 6. Demanda Agregada. Multiplicadordavid artecheNo ratings yet

- EMP2 - U04 - Apunts - Fiscal It at RialDocument11 pagesEMP2 - U04 - Apunts - Fiscal It at RialJotace DtNo ratings yet

- FISCALITATDocument16 pagesFISCALITATirinavazquezsolaNo ratings yet

- Experiència 1 - Determinar La Costant Elàstica Duna MollaDocument3 pagesExperiència 1 - Determinar La Costant Elàstica Duna MollaPrecious OmogbaiNo ratings yet

- Experiència 4 - Demostració Del Principi DhidroestàticaDocument3 pagesExperiència 4 - Demostració Del Principi DhidroestàticaPrecious OmogbaiNo ratings yet

- Projecte de Recerca - 2023 - Precious OmogbaiDocument13 pagesProjecte de Recerca - 2023 - Precious OmogbaiPrecious OmogbaiNo ratings yet

- Experiència 2 - Demostració Del Principi DArquímedesDocument2 pagesExperiència 2 - Demostració Del Principi DArquímedesPrecious OmogbaiNo ratings yet

- Els Viatges de Marco PoloDocument2 pagesEls Viatges de Marco PoloPrecious OmogbaiNo ratings yet

- VikingsDocument5 pagesVikingsPrecious OmogbaiNo ratings yet

- Trajectòria, Desplaçament I VelocitatDocument5 pagesTrajectòria, Desplaçament I VelocitatPrecious OmogbaiNo ratings yet