Professional Documents

Culture Documents

Letter To Commissioner BIR

Uploaded by

eugene juliusOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Letter To Commissioner BIR

Uploaded by

eugene juliusCopyright:

Available Formats

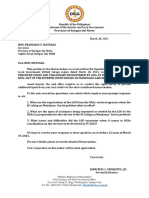

ROMEO D. LUMAGUI JR.

Commissioner

Bureau of Internal Revenue

BIR National Office Bldg.

BIRRoad, Diliman

Quezon City

Dear Commissioner Lumagui,

Greetings!

Our company, under your jurisdiction, with registered address at 23 Victoria Village,

Canumay, Valenzuela City and with Tax Identification Number 001-459-693-000 has a

pending internal revenue case described in the attached “Annex A” of the letter.

In line with that, may we ask for your permission to allow us to avail the remedy of

compromise under Section 204 of RA 8424 otherwise known as National Internal

Revenue Code of the Philippines, stating that the Commissioner of Internal Revenue (CIR)

is authorized to compromise taxes in the Philippines or to allow payments of taxes at

minimal amounts in certain instances, and in accordance with Revenue Regulation No.

30-2002, which provides specific instances where tax liability in the Philippines could be

compromised.

Upon review of the regulations and issuances stated above, it brought to our knowledge

that we can avail this remedy falling under the category of financial incapability of the

taxpayer to settle its assessed taxes. With that, we are requesting you to allow us avail the

10% deficiency tax payment due to the said reason.

Also, as seen on our 2015 Audited Financial Statements, our total liabilities is 94.23% of

our total assets which results to a high debt-to-assets ratio, which we all know that is not

good for any Company as it means that all the assets acquired by the Company comes from

debt.

We trust that the foregoing sufficiently justified our request to avail the compromise

settlement and will merit your favorable consideration. Thank you.

Respectfully yours,

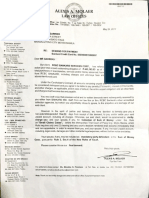

This pertains to the remittance of tax withheld from compensation under BIR Form

1601C of this Bureau for the month of December 2023 in the amount of (in words)

(P_______), which was remitted on January 17, 2024, rather than the required date of

remittance, which was January 15, 2023.

College, 4031, Laguna, Philippines

Tel Nos: (6349)5363628; 5362229; 5362269 Fax No. (6349)5362850

E-mail: erdb@denr.gov.ph

The Bureau has been highly meticulous in remitting its withheld taxes, often

remitting them before the due date as shown in the attached schedule of remittances for the

last three (3) years. The remittance of such tax taken from compensation was overlooked

this month due to the numerous reports the Bureau is required to provide to various

government organizations such as the DENR Central Office, the DBM, and the COA.

In view of this, we respectfully request for the waiver of the surcharge resulting

from the late submission of the withheld tax.

For your consideration.

Very truly yours,

MARIA LOURDES G. FERRER, CESO III

College, 4031, Laguna, Philippines

Tel Nos: (6349)5363628; 5362229; 5362269 Fax No. (6349)5362850

E-mail: erdb@denr.gov.ph

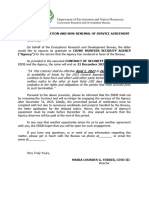

AUTHORIZATION

To whom it may concern:

This is to authorize Ms. Dorila Dolloso Cariño, Liaison Officer of the Ecosystems

Research and Development Bureau to claim my Ombudsman Clearance which I mailed

last November 23, 2023. Attached is a copy of the registry receipt as ready reference.

Thank you very much.

DAISY L. ENGLE

College, 4031, Laguna, Philippines

Tel Nos: (6349)5363628; 5362229; 5362269 Fax No. (6349)5362850

E-mail: erdb@denr.gov.ph

You might also like

- Hon. Marco Anacleto P. Buena: Preliminary Investigation, Administrative Adjudication, and Prosecution Bureau-BDocument2 pagesHon. Marco Anacleto P. Buena: Preliminary Investigation, Administrative Adjudication, and Prosecution Bureau-BGeramer Vere DuratoNo ratings yet

- Letter To DILG For The 2nd Batch PayoutDocument2 pagesLetter To DILG For The 2nd Batch Payouthermanos belenNo ratings yet

- Important Reminders: Step 1Document4 pagesImportant Reminders: Step 1Jamir ToledanaNo ratings yet

- Letter To Matugas On Rapid Survey To Mandanas RulingDocument1 pageLetter To Matugas On Rapid Survey To Mandanas RulingBenflor J. BiongNo ratings yet

- Before and After BitesDocument5 pagesBefore and After Bitesmaria dariaNo ratings yet

- Salesman, Negros Oriental: Prepared byDocument1 pageSalesman, Negros Oriental: Prepared byMark BatiNo ratings yet

- Oath of Office 2Document3 pagesOath of Office 2melvinburbos938No ratings yet

- Memorandum: Department of EducationDocument2 pagesMemorandum: Department of EducationGlenn E. DicenNo ratings yet

- Cso Letter of IntentDocument2 pagesCso Letter of Intentvdeguzman0122No ratings yet

- Important Reminders: Step 1Document4 pagesImportant Reminders: Step 1fredeielyn lesiguesNo ratings yet

- 113634-E-Lgu-Xii-Brgy Diragun, Marogong, Lds-Letter Dated September 20, 2023Document1 page113634-E-Lgu-Xii-Brgy Diragun, Marogong, Lds-Letter Dated September 20, 2023Ruffaidah Daing Benito-ZacariaNo ratings yet

- Complete Staff WorkDocument2 pagesComplete Staff WorkPENRO Cavite Finance SectionNo ratings yet

- Letter To ESR Asphalt No. 2Document1 pageLetter To ESR Asphalt No. 2Rihan PalerNo ratings yet

- Termination Letter For PLDTDocument1 pageTermination Letter For PLDTClimz Aether100% (1)

- Important Reminders: Step 1Document4 pagesImportant Reminders: Step 1Angel AchumbreNo ratings yet

- MC Process For British Nationals Who Wish To Obtain Marriage License in The Philippines CAHC SignedDocument2 pagesMC Process For British Nationals Who Wish To Obtain Marriage License in The Philippines CAHC SignedKayzee GimenoNo ratings yet

- Letter Invitation - Training On Legal Instrument - Aringay 2Document1 pageLetter Invitation - Training On Legal Instrument - Aringay 2Marijoe Kate HufalarNo ratings yet

- Dear Qualifiers District1!5!27-19 AMDocument2 pagesDear Qualifiers District1!5!27-19 AMReinelle Gail SantosNo ratings yet

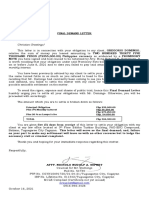

- Final Demand Letter - SRN CABUHATDocument1 pageFinal Demand Letter - SRN CABUHATSRN Credit CollectionNo ratings yet

- Engagement LetterDocument3 pagesEngagement LetterajaNo ratings yet

- Meeting PBs 2Document1 pageMeeting PBs 2Muhammad AbutazilNo ratings yet

- Virtual SeminarDocument1 pageVirtual SeminaranonymousNo ratings yet

- 2020form - MC28s2020 Annexes D To GDocument1 page2020form - MC28s2020 Annexes D To GJefran OlingayNo ratings yet

- Cancel Cadastral LienDocument2 pagesCancel Cadastral LienDon SalaNo ratings yet

- Letter To Permit Holders August-2020Document4 pagesLetter To Permit Holders August-2020Dennis DagoocNo ratings yet

- Lgu Fa 2024 117541Document3 pagesLgu Fa 2024 117541kepulangco101898No ratings yet

- Letter of Request To Bir.2.2020Document1 pageLetter of Request To Bir.2.2020black stalkerNo ratings yet

- Study Leave Contract: Department of The Interior and Local GovernmentDocument3 pagesStudy Leave Contract: Department of The Interior and Local GovernmentsherylNo ratings yet

- Endorsement LetterDocument1 pageEndorsement Letterimeldamondejar5No ratings yet

- PUPCL OJT Internship Acceptance Plan 2Document4 pagesPUPCL OJT Internship Acceptance Plan 2Lyca CariagaNo ratings yet

- Letter Marlon Erro - EditedDocument7 pagesLetter Marlon Erro - EditedMelchor CasibangNo ratings yet

- Office Lens 20170612-230022Document1 pageOffice Lens 20170612-230022Arden KimNo ratings yet

- Justification LetterDocument1 pageJustification LetterAldrin NolascoNo ratings yet

- Acknowledgement-receipt-School 2 (2) 365Document4 pagesAcknowledgement-receipt-School 2 (2) 365Arvin DayagNo ratings yet

- Beltran - Entry of AppearanceDocument3 pagesBeltran - Entry of AppearanceDonna Marie OmosoNo ratings yet

- Letter To Matugas Requesting Annexes To Be AccomplishedDocument2 pagesLetter To Matugas Requesting Annexes To Be AccomplishedBenflor J. BiongNo ratings yet

- Foia Fuds Us Ace Jul 3 2023Document6 pagesFoia Fuds Us Ace Jul 3 2023CORALationsNo ratings yet

- Arnel D. Garcia, Ceso IiiDocument1 pageArnel D. Garcia, Ceso Iiijerick16No ratings yet

- Motion For ExtensionDocument41 pagesMotion For ExtensionAidriane VhonNo ratings yet

- Contract New Jul To Dec - Page-0001 (8 Files Merged)Document8 pagesContract New Jul To Dec - Page-0001 (8 Files Merged)Dadz CoraldeNo ratings yet

- Formal EntryDocument4 pagesFormal EntryChristian Nehru ValeraNo ratings yet

- Important Reminders: Step 1Document4 pagesImportant Reminders: Step 1Wendell RapasNo ratings yet

- OWMSDocument43 pagesOWMSJosephine Jagorin100% (1)

- Division Memo-December 22, 2023Document2 pagesDivision Memo-December 22, 2023BonifacioNo ratings yet

- Intention To Avail Tax AmnestyDocument3 pagesIntention To Avail Tax AmnestyGemma RetubaNo ratings yet

- Draft Letter For TerminationDocument2 pagesDraft Letter For Terminationeugene juliusNo ratings yet

- Demand For Payment ResonanzDocument1 pageDemand For Payment ResonanzMiami Fae Briones Magpantay-ButaslacNo ratings yet

- Important Reminders: Step 1Document4 pagesImportant Reminders: Step 1Aila Erika EgrosNo ratings yet

- Pearson Specter & Associates: Letter of DemandDocument2 pagesPearson Specter & Associates: Letter of DemandNorvie Aine PasiaNo ratings yet

- FER004 Application Centrepay DeductionDocument1 pageFER004 Application Centrepay DeductionBrayden LeesonNo ratings yet

- Mr. Jayvee T. Mamauag: Christian Greetings!Document2 pagesMr. Jayvee T. Mamauag: Christian Greetings!nicholoNo ratings yet

- CNPCDocument41 pagesCNPCLeny Agcaoili FiestaNo ratings yet

- MOTION Assumption OfficeDocument3 pagesMOTION Assumption Officetimothy miraflorNo ratings yet

- Letter RequestDocument1 pageLetter RequestDiomaris BasioNo ratings yet

- Sample Pleading 3Document3 pagesSample Pleading 3judison guiabelNo ratings yet

- Facsimile Transmission: Sucofindo InternationalDocument1 pageFacsimile Transmission: Sucofindo InternationalUpload ManiaNo ratings yet

- Letter of Cancellation-AtpDocument1 pageLetter of Cancellation-AtpJohn Kenneth Elfa100% (2)

- Engagement Proposal - BAI ANESADocument3 pagesEngagement Proposal - BAI ANESAShyne AmpatuanNo ratings yet

- Certification Acct Uti2Document1 pageCertification Acct Uti2lnbsanclementeNo ratings yet

- Draft Moa Erdb Denr-Ncr - EditedDocument4 pagesDraft Moa Erdb Denr-Ncr - Editedeugene juliusNo ratings yet

- Certification of No Objection Uprooted TreesDocument2 pagesCertification of No Objection Uprooted Treeseugene juliusNo ratings yet

- Draft MOA JohnHay CPD ReviewedDocument7 pagesDraft MOA JohnHay CPD Reviewedeugene juliusNo ratings yet

- NOKIs Procurement PsDocument6 pagesNOKIs Procurement Pseugene juliusNo ratings yet

- Extension AlexisDocument1 pageExtension Alexiseugene juliusNo ratings yet

- EDITED - Notice of Non Compliance For UniformDocument7 pagesEDITED - Notice of Non Compliance For Uniformeugene juliusNo ratings yet

- Internship MOA - upLBStatDocument6 pagesInternship MOA - upLBStateugene juliusNo ratings yet

- Tel Nos: (6349) 5363628 5362229 5362269 Fax No. (6349) 5362850 E-Mail: Erdb@denr - Gov.phDocument2 pagesTel Nos: (6349) 5363628 5362229 5362269 Fax No. (6349) 5362850 E-Mail: Erdb@denr - Gov.pheugene juliusNo ratings yet

- Comments On The Draft Moa Between Pasig River Coordinating and Management Office and ErdbDocument3 pagesComments On The Draft Moa Between Pasig River Coordinating and Management Office and Erdbeugene juliusNo ratings yet

- MOA Water RefilingDocument3 pagesMOA Water Refilingeugene julius100% (1)

- Sample Script For Pre-Hearing ConferenceDocument1 pageSample Script For Pre-Hearing ConferenceAthena SalasNo ratings yet

- Tel Nos: (6349) 5363628 5362229 5362269 Fax No. (6349) 5362850 E-Mail: Erdb@denr - Gov.phDocument2 pagesTel Nos: (6349) 5363628 5362229 5362269 Fax No. (6349) 5362850 E-Mail: Erdb@denr - Gov.pheugene juliusNo ratings yet

- Affidavit of Loss For DarleenDocument2 pagesAffidavit of Loss For Darleeneugene juliusNo ratings yet

- Special Power of AttorneyDocument2 pagesSpecial Power of AttorneyKaine LagalagNo ratings yet

- DoasDocument4 pagesDoaseugene juliusNo ratings yet

- PNP Formal ChargeDocument2 pagesPNP Formal Chargeeugene juliusNo ratings yet

- Ease of Doing BusinessDocument25 pagesEase of Doing Businesseugene juliusNo ratings yet

- Chapter 8 - Bank ReconciliationDocument6 pagesChapter 8 - Bank ReconciliationAdan EveNo ratings yet

- Avni Final Presentation - 2013Document36 pagesAvni Final Presentation - 2013whattodo next.2021No ratings yet

- Rusoro Mining Ltd. Vancouver, B.CDocument110 pagesRusoro Mining Ltd. Vancouver, B.CfrainkelyNo ratings yet

- 3rd NCR Cup Junior Edition Quiz Bee KPMGDocument17 pages3rd NCR Cup Junior Edition Quiz Bee KPMGrcaa04100% (1)

- Case Analysis: A Simple Strategy at Costco: Informative Background InformationDocument15 pagesCase Analysis: A Simple Strategy at Costco: Informative Background InformationFred Nazareno CerezoNo ratings yet

- Chapter 11 NISMDocument12 pagesChapter 11 NISMKiran VidhaniNo ratings yet

- Dharavi Redevelopment ProjectDocument1 pageDharavi Redevelopment ProjectDanish MallickNo ratings yet

- Lesotho Times 27 July 2023 - 230727 - 093523Document32 pagesLesotho Times 27 July 2023 - 230727 - 093523Tsepo ShataNo ratings yet

- RFP DOCUMENT FOR EPC 28.11.2018 - Copy 2Document84 pagesRFP DOCUMENT FOR EPC 28.11.2018 - Copy 2Nitu SinghNo ratings yet

- Kelvin Lau MWI +RRDocument18 pagesKelvin Lau MWI +RRUniversityJCNo ratings yet

- Research Proposal Selection ProposalDocument11 pagesResearch Proposal Selection ProposalRANDAN SADIQNo ratings yet

- Summer Internship Project Study On Ledger Entry Using Tally With Reference To Gyan Ganga LTDDocument25 pagesSummer Internship Project Study On Ledger Entry Using Tally With Reference To Gyan Ganga LTDAbhiNo ratings yet

- Reema KhanDocument1 pageReema Khanattock jadeedNo ratings yet

- Business Plan Project Student TemplateDocument16 pagesBusiness Plan Project Student TemplateMiomayaNo ratings yet

- Sticky Branding Work BookDocument38 pagesSticky Branding Work BookChjk PinkNo ratings yet

- AIKBEA & KBOO Cir 9-2022Document4 pagesAIKBEA & KBOO Cir 9-2022Nihar RanjanNo ratings yet

- Nifty 50 FactsheetDocument2 pagesNifty 50 FactsheetShubhashish SaxenaNo ratings yet

- Electronic Word of Mouth DissertationDocument6 pagesElectronic Word of Mouth DissertationWriteMyNursingPaperSingapore100% (1)

- 6 Mark Grade Boundary:: MarkschemeDocument22 pages6 Mark Grade Boundary:: Markschemeqi huangNo ratings yet

- Session 9 - Get Roposo The Fashionable Social Media PDFDocument6 pagesSession 9 - Get Roposo The Fashionable Social Media PDFDivya GiriNo ratings yet

- Financial Reporting - Prof. ManojDocument6 pagesFinancial Reporting - Prof. Manojtechna8No ratings yet

- Buying Sales Leads - Is It Right For Your Company?Document2 pagesBuying Sales Leads - Is It Right For Your Company?MikhailNo ratings yet

- MP Boutique Standards 2020Document12 pagesMP Boutique Standards 2020YohannaNo ratings yet

- Ansell Healthcare Products LLC To Acquire Exam Specialty Glove Supplier DigitcareDocument2 pagesAnsell Healthcare Products LLC To Acquire Exam Specialty Glove Supplier DigitcareRazvanRotaruNo ratings yet

- Maintenance and Warranty Processing (274) : S/4HANA 1610 2017Document24 pagesMaintenance and Warranty Processing (274) : S/4HANA 1610 2017Secret EarthNo ratings yet

- Tung Lok Restaurants 2000 LTD Annual Report 2019Document158 pagesTung Lok Restaurants 2000 LTD Annual Report 2019WeR1 Consultants Pte LtdNo ratings yet

- Lecture 5-6 BudgetingDocument15 pagesLecture 5-6 BudgetingAfzal AhmedNo ratings yet

- How Agile Principles Drive TransformDocument6 pagesHow Agile Principles Drive TransformCinthy RevillaNo ratings yet

- Race and SportsDocument29 pagesRace and SportsAngela BrownNo ratings yet

- ABM Module 3 Week 3 ORG. AND MANAGEMENT FINAL MODULEDocument13 pagesABM Module 3 Week 3 ORG. AND MANAGEMENT FINAL MODULEJay Mark InobayaNo ratings yet