Professional Documents

Culture Documents

Manila Standard Today - Business Daily Stocks Review (October 1, 2013)

Uploaded by

Manila Standard TodayCopyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Manila Standard Today - Business Daily Stocks Review (October 1, 2013)

Uploaded by

Manila Standard TodayCopyright:

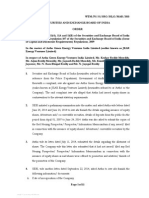

MST Business Daily Stocks Review

M

S

T

Tuesday, October 1, 2013

52 Weeks

High Low

STOCKS

Previous

Close

2.75

105.5

99

114

481.8

2.42

21.65

37.85

24

3.25

39.2

0.73

139.5

2.09

38.85

117

515

74.5

206.4

160

2.92

2.12

68

58.9

71.75

48

1.32

17.7

19.3

10.08

2

19.08

0.2

90.2

1.64

23.7

68.75

360

43

117.7

101

1.79

AG Finance

Asia United Bank

Banco de Oro Unibank Inc.

Bank of PI

China Bank

BDO Leasing & Fin. Inc.

COL Financial

Eastwest Bank

Filipino Fund Inc.

I-Remit Inc.

Maybank ATR KE

MEDCO Holdings

Metrobank

Natl Reinsurance Corp.

PB Bank

Phil. National Bank

PSE Inc.

RCBC `A

Security Bank

Union Bank

Vantage Equities

3.39

72.3

75.00

96.40

60.00

1.90

17.1

26.85

17.10

2.71

30

0.240

83.00

1.65

24.15

87.40

358.8

45.5

131.1

122.00

2.66

40.5

2.26

50.5

1.59

39

11

3.12

29.3

8.24

30.25

8.6

7.9

15.9

27.45

113.8

19.96

0.027

15.98

5

179.5

12.24

3.1

28.4

2.5

41.4

24.2

22.5

397

6.88

16.3

19.48

11.18

6.15

2.49

125

900

3.34

3.3

3

132.6

2.92

2.08

2.92

30.5

1.15

13

1.2

17

2.42

2.54

9.25

0.96

20

4.32

4.94

7.2

15.7

68

12.5

0.0130

11.98

2.15

94

8.4

1.8

11.34

1.39

26.2

12.7

2.5

240

3.36

9.88

10.16

4.8

3.88

1.1

76.4

210

0.9

1.59

1.08

59.9

1.79

0.580

1.79

Aboitiz Power Corp.

Alliance Tuna Intl Inc.

Alphaland Corp.

Alsons Cons.

Asiabest Group

Calapan Venture

Chemrez Technologies Inc.

Cirtek Holdings (Chips)

Da Vinci Capital

Del Monte

DNL Industries Inc.

Energy Devt. Corp. (EDC)

EEI

First Gen Corp.

First Holdings A

Ginebra San Miguel Inc.

Greenergy

Holcim Philippines Inc.

Integ. Micro-Electronics

Jollibee Foods Corp.

Lafarge Rep

LMG Chemicals

LT Group

Mabuhay Vinyl Corp.

Manila Water Co. Inc.

Megawide

Melco Crown

Mla. Elect. Co `A

Pepsi-Cola Products Phil.

Petron Corporation

Phinma Corporation

Phoenix Petroleum Phils.

RFM Corporation

Roxas and Co.

San Miguel Corp `A

San MiguelPure Foods `B

Seacem

TKC Steel Corp.

Trans-Asia Oil

Universal Robina

Victorias Milling

Vitarich Corp.

Vulcan Indl.

31.5

1.12

43.7

1.30

15.62

5.5

3.00

14.8

1.02

26

6.54

5.45

9.67

16.7

74.9

24.60

0.0130

12.70

3

168.50

9.42

3.06

18

3.27

28.25

12.460

11

286.00

4.6

12.80

13.30

5.16

4.85

2.45

74.80

242.6

0.98

2.08

2.05

123.00

1.63

0.71

1.44

0.81

61

28.4

7.3

688

18.1

61.2

883.5

9.3

50

6

5.7

7.68

1.39

0.81

2.39

6.33

7.65

3.4

0.420

1213

0.315

0.770

0.61

40

11.22

4.53

409

0.017

44

521

4.75

31.4

3.25

2.3

4.75

0.61

0.320

1.400

4

4.7

2

0.290

702

0.189

0.270

Abacus Cons. `A

Aboitiz Equity

Alliance Global Inc.

Anscor `A

Ayala Corp `A

Cosco Capital

DMCI Holdings

GT Capital

House of Inv.

JG Summit Holdings

Keppel Holdings `A

Keppel Holdings `B

Lopez Holdings Corp.

Lodestar Invt. Holdg.Corp.

Mabuhay Holdings `A

Marcventures Hldgs., Inc.

Metro Pacific Inv. Corp.

Minerales Industrias Corp.

Republic Glass A

Sinophil Corp.

SM Investments Inc.

Unioil Res. & Hldgs

Zeus Holdings

0.58

45.00

23.50

6.45

604.5

9.77

46.00

760

6.00

38.60

4.8

5.3

4.53

0.77

0.640

1.81

4.50

5.3

2.67

0.290

780.00

0.1670

0.370

48

3.89

2.26

0.240

35.7

7.1

6.73

2.44

3

0.91

1.21

0.445

2.76

2.27

1.73

4.5

4.31

0.197

0.840

26.9

3.74

3.95

21.9

1.35

4.1

2.4

2.92

15

1.5

0.47

0.168

21.4

4.41

3.7

1.2

1.21

0.49

0.78

0.157

1.54

1.25

1.05

1.6

2.15

0.077

0.405

17.9

1.98

2.62

13.58

0.58

3.42

0.49

1.79

Anchor Land Holdings Inc.

A. Brown Co., Inc.

Araneta Prop `A

Arthaland Corp.

Ayala Land `B

Belle Corp. `A

Cebu Holdings

Century Property

City & Land Dev.

Cyber Bay Corp.

Empire East Land

Ever Gotesco

Global-Estate

Filinvest Land,Inc.

Interport `A

Keppel Properties

Megaworld Corp.

MRC Allied Ind.

Phil. Estates Corp.

Robinsons Land `B

Rockwell

Shang Properties Inc.

SM Prime Holdings

Sta. Lucia Land Inc.

Starmalls

Suntrust Home Dev. Inc.

Vista Land & Lifescapes

22.75

1.34

1.420

0.200

27.25

4.9

5.9

1.54

1.68

0.54

0.960

0.250

1.35

1.60

1.43

2.80

3.26

0.0910

0.3950

20.60

1.84

3.15

16.02

0.62

3.58

1.200

5.330

3.15

47

1.61

0.95

16.04

16.88

0.2090

7.78

84.8

12.5

6.56

1670

9.99

100.5

10

0.07

9.9

1.06

3.49

1.29

5.99

16

7.83

3.47

150

17.06

3290

0.365

43.6

2.42

22

2.7

0.48

1.62

24.1

1.01

0.6

8.9

8.36

0.1090

3.1

50.8

9.92

3.72

1058

8.08

65.9

4.65

0.016

6

0.6

1.91

0.3

0.010

13.78

4.5

1.9

67.5

11.90

2480

0.275

28.1

0.75

3.53

1.68

0.315

2GO Group

ABS-CBN

Acesite Hotel

APC Group, Inc.

Asian Terminals Inc.

Bloomberry

Boulevard Holdings

Calata Corp.

Cebu Air Inc. (5J)

Centro Esc. Univ.

DFNN Inc.

Globe Telecom

GMA Network Inc.

I.C.T.S.I.

IPeople Inc. `A

IP E-Game Ventures Inc.

Leisure & Resorts

Manila Bulletin

Manila Jockey

MG Holdings

Nextstage Inc.

Pacific Online Sys. Corp.

PAL Holdings Inc.

Paxys Inc.

Phil. Seven Corp.

Philweb.Com Inc.

PLDT Common

PremiereHorizon

Puregold

STI Holdings

Touch Solutions

Transpacific Broadcast

Waterfront Phils.

1.8

33

1.17

0.750

11.5

10.02

0.1350

3.02

52.5

11.3

4.30

1600

7.70

97

12

0.014

6.08

0.74

2.1

0.370

1.98

16.5

5.55

2

109.00

11.10

2978.00

0.260

41.70

0.73

9

2.17

0.390

0.0068

5.55

23.35

28.05

0.315

25.5

25

1.35

1.68

25.3

0.6

1.29

1.380

0.066

0.073

28.55

8.48

0.780

4.95

0.026

7.24

19.76

37.3

0.052

305.8

0.021

0.0036

1.9

13.4

10

0.240

12

8.3

0.7

0.85

5.35

0.4

0.3950

0.4250

0.028

0.030

14.78

2.55

0.500

1.16

0.016

5.8

8.8

8.5

0.033

214.4

0.013

Abra Mining

Apex `A

Atlas Cons. `A

Atok-Big Wedge `A

Basic Energy Corp.

Benguet Corp `A

Benguet Corp `B

Century Peak Metals Hldgs

Coal Asia

Dizon

Geograce Res. Phil. Inc.

Lepanto `A

Lepanto `B

Manila Mining `A

Manila Mining `B

Nickelasia

Nihao Mineral Resources

Omico

Oriental Peninsula Res.

Oriental Pet. `A

Petroenergy Res. Corp.

Philex `A

PhilexPetroleum

Philodrill Corp. `A

Semirara Corp.

United Paragon

0.0032

2.92

12.20

20.00

0.243

8.6

8

0.6

0.98

5.10

0.445

0.420

0.450

0.0240

0.0260

15.48

2.8

0.4500

1.450

0.0190

5.98

7.95

9.48

0.039

240.00

0.0120

49.9

545

10.26

115

80.5

77.5

84

1080

22.65

501

7.94

104.1

74.5

73

74.5

1005

ABS-CBN Holdings Corp.

Ayala Corp. Pref `A

GMA Holdings Inc.

PCOR-Preferred

SMC Preferred A

SMC Preferred B

SMC Preferred C

SMPFC Preferred

35

508

7.28

109.5

76.75

76.5

77

1041

11.88

4.21

Ripple E-Business Intl

17.5

High

Low

FINANCIAL

3.41

3.32

72.8

71.8

75.65

73.70

96.00

93.70

61.00

59.00

1.92

17.18

17

26.85

26.05

17.90

16.00

2.72

2.72

35.95

32

0.240

0.235

85.00

83.25

1.65

1.65

24.3

24.1

87.00

84.60

360

356

45.55

44.6

135.5

130.1

123.90

121.90

2.66

2.66

INDUSTRIAL

32.9

31.45

1.14

1.09

43.7

43

1.35

1.29

15.68

15.6

5.5

5.49

2.99

2.99

1.9

14.9

1.07

1.01

27.15

26.15

6.520

6.5

5.60

5.50

9.68

9.55

16.9

16.18

74.75

74

26.65

24.65

0.0130

0.0130

13.48

12.70

3.16

2.85

171.00

167.00

9.5

9.36

3.15

3.05

18.18

17.52

3.19

2.12

28.5

27.5

12.500

12.360

10.9

10.3

299.00

285.80

4.74

4.55

13.08

12.70

13.20

13.20

5.15

5.08

5.01

4.85

2.35

2.35

78.05

74.95

242.6

240

1.00

0.96

2.30

2.01

2.09

2.04

123.30

119.00

1.62

1.6

0.75

0.69

1.43

1.42

HOLDING FIRMS

0.58

0.58

45.95

45.00

24.30

22.95

6.50

6.45

602

591

9.88

9.71

46.80

45.10

775

761.5

6.20

6.00

41.00

38.50

4.8

4.8

4.8

4.8

4.8

4.6

0.78

0.75

0.650

0.640

1.9

1.81

4.58

4.48

5.3

5.2

2.6

2.6

0.290

0.290

799.00

772.00

0.1670

0.1670

0.375

0.370

PROPERTY

22.75

22.75

1.30

1.20

1.450

1.400

0.208

0.200

27.95

27.10

4.94

4.81

5.5

5.5

1.56

1.51

1.58

1.58

0.55

0.53

0.960

0.940

0.260

0.245

1.39

1.33

1.62

1.59

1.47

1.42

2.80

2.50

3.34

3.24

0.0930

0.0930

0.4450

0.3800

21.00

20.65

1.85

1.8

3.15

3.15

16.32

16.00

0.63

0.62

3.7

3.31

1.270

1.170

5.330

5.150

SERVICES

1.79

1.79

33

33

1.16

1.05

0.750

0.740

11.5

11.38

10.34

10.02

0.1370

0.1340

3.02

2.98

52.4

50.2

11.28

11.2

4.30

4.26

1610

1580

8.05

7.80

100

97.05

12

12

0.014

0.013

6.02

5.98

0.73

0.72

2.1

2.1

0.370

0.370

1.96

1.96

16.6

15.5

5.83

5.57

2

1.99

109.00

100.00

11.20

10.90

3004.00

2950.00

0.260

0.260

41.70

40.50

0.74

0.70

9.34

8.88

2.1

1.98

0.380

0.375

MINING & OIL

0.0032

0.0030

2.97

2.93

12.24

12.16

20.00

19.96

0.243

0.241

8.2

7.76

7.92

7.92

0.61

0.58

0.98

0.96

5.24

5.05

0.460

0.440

0.430

0.405

0.450

0.425

0.0250

0.0230

0.0270

0.0250

15.5

15.12

2.8

2.7

0.4500

0.4500

1.400

1.380

0.0190

0.0180

5.96

5.95

7.970

7.860

9.1

8.65

0.040

0.038

245.00

240.40

0.0120

0.0110

PREFERRED

35

34.9

503

503

7.5

7.3

109.2

109.1

76.85

76.5

76.4

76.4

77

76.8

1050

1050

SME

17.98

17

Close Change Volume

Net Foreign

Trade/Buying

3.39

72.25

73.70

96.00

60.90

1.92

17.18

26.1

17.90

2.72

32

0.240

84.00

1.65

24.1

84.80

359

44.6

133.6

122.00

2.66

0.00

-0.07

-1.73

-0.41

1.50

1.05

0.47

-2.79

4.68

0.37

6.67

0.00

1.20

0.00

-0.21

-2.97

0.06

-1.98

1.91

0.00

0.00

185,000

119,370

5,227,100

2,302,880

24,740

13,000

1,300

212,900

51,000

1,000

300

260,000

6,911,140

200,000

173,100

477,700

17,540

1,127,500.00

702,880

98,230

5,000

32.05

1.1

43.7

1.29

15.68

5.5

2.99

14.9

1.03

26.15

6.5

5.56

9.55

16.5

74.3

26.50

0.0130

12.70

3

168.60

9.37

3.11

18.18

3.19

27.55

12.360

10.3

295.00

4.55

12.98

13.20

5.11

4.99

2.35

75.40

241

1.00

2.01

2.06

120.00

1.6

0.69

1.43

1.75

-1.79

0.00

-0.77

0.38

0.00

-0.33

0.68

0.98

0.58

-0.61

2.02

-1.24

-1.20

-0.80

7.72

0.00

0.00

0.00

0.06

-0.53

1.63

1.00

-2.45

-2.48

-0.80

-6.36

3.15

-1.09

1.41

-0.75

-0.97

2.89

-4.08

0.80

-0.66

2.04

-3.37

0.49

-2.44

-1.84

-2.82

-0.69

1,678,000

723,000

4,600

60,000

2,400

41,800

50,000

1,600

851,000

3,200

9,708,300

6,226,700

218,200

2,715,200

146,690

2,470,100

69,600,000

5,504,500

23,000

493,230

149,500

53,000

2,805,000

11,000

1,301,200

149,500

857,700

2,516,040

1,222,000

1,760,300

600

31,200

2,083,000

4,000

950,580

66,150

44,000

381,000

1,651,000

3,872,370

127,000

2,882,000

235,000

0.58

45.70

23.30

6.50

595

9.8

45.10

765

6.00

39.75

4.8

4.8

4.6

0.77

0.650

1.81

4.55

5.3

2.6

0.290

772.00

0.1670

0.370

0.00

1.56

-0.85

0.78

-1.57

0.31

-1.96

0.66

0.00

2.98

0.00

-9.43

1.55

0.00

1.56

0.00

1.11

0.00

-2.62

0.00

-1.03

0.00

0.00

2,361,000.00

1,290,300

30,682,400

81,600

495,190

5,946,100

6,238,100

359,640

10,700

5,265,500

23,000

19,400

6,242,000

30,000

86,000

264,000

77,614,000

55,000

18,000

640,000

346,830

10,000

50,000

22.75

1.29

1.450

0.208

27.45

4.84

5.5

1.51

1.58

0.55

0.950

0.245

1.33

1.61

1.45

2.50

3.32

0.0930

0.3800

20.85

1.82

3.15

16.06

0.62

3.7

1.220

5.200

0.00

-3.73

2.11

4.00

0.73

-1.22

-6.78

-1.95

-5.95

1.85

-1.04

-2.00

-1.48

0.63

1.40

-10.71

1.84

2.20

-3.80

1.21

-1.09

0.00

0.25

0.00

3.35

1.67

-2.44

3,000

1,126,000

133,000

20,000

14,920,600

6,582,000

12,000

14,348,000

28,000

1,113,000

321,000

190,000

2,267,000

25,342,000

524,000

59,000

12,883,000

190,000

200,000

1,664,700

1,148,000

7,000

20,871,900

816,000

63,000

2,181,000

7,938,100

1.79

33

1.16

0.750

11.5

10.20

0.1340

3.01

50.4

11.28

4.30

1590

8.00

99.4

12

0.013

5.98

0.72

2.1

0.370

1.96

16.5

5.83

2

100.20

11.20

2980.00

0.260

41.70

0.70

8.99

2.1

0.380

-0.56

0.00

-0.85

0.00

0.00

1.80

-0.74

-0.33

-4.00

-0.18

0.00

-0.63

3.90

2.47

0.00

-7.14

-1.64

-2.70

0.00

0.00

-1.01

0.00

5.05

0.00

-8.07

0.90

0.07

0.00

0.00

-4.11

-0.11

-3.23

-2.56

1,000

1,000

102,000

919,000

41,900

10,022,500

18,980,000

467,000

281,140

18,300

183,000

111,375

3,900

450,310

200

149,400,000

230,800

70,000

160,000

50,000

3,000

25,300

31,800

152,000

2,050

2,501,600

81,865

2,010,000

1,024,500

4,858,000

12,435,400

4,000

20,000

0.0030

2.93

12.16

20.00

0.241

8.2

7.92

0.6

0.96

5.22

0.445

0.410

0.425

0.0240

0.0250

15.12

2.78

0.4500

1.380

0.0190

5.95

7.86

8.7

0.039

244.20

0.0120

-6.25

0.34

-0.33

0.00

-0.82

-4.65

-1.00

0.00

-2.04

2.35

0.00

-2.38

-5.56

0.00

-3.85

-2.33

-0.71

0.00

-4.83

0.00

-0.50

-1.13

-8.23

0.00

1.75

0.00

50,000,000

100,000

608,300

3,400

240,000

5,100

13,900

700,000

900,000

89,200

290,000

33,830,000

7,060,000

122,800,000

124,500,000

159,100

175,000

100,000

147,000

231,800,000

18,200

1,967,100

483,400

334,300,000

44,560

15,700,000

34.9

503

7.36

109.1

76.8

76.4

76.95

1050

-0.29

-0.98

1.10

-0.37

0.07

-0.13

-0.06

0.86

86,000

60

85,600

18,230

345,450

4,410

91,590

230

17

-2.86

2,300

-3,683,428.00

-107,397,855.50

-53,157,652.00

216,302.00

-3,133,160.00

29,408,388.50

-330,000.00

2,658,745.00

8,723,814.50

-3,090,672.00

-2,985,175.00

22,723,197.00

-5,055,632.00

2,218,890.00

58,950.00

4,288,440.00

242,970.00

-419,569.00

30,297,092.00

-7,592,548.00

2,652,500.00

70,127,360.00

-27,260,901.00

327,757.00

71,750.00

7,366,450.00

1,383,520.00

-1,645,008.00

-3,780,512.00

189,712,904.00

66,650.00

16,864,688.00

-75,073.00

5,241,210.00

-6,532,624.50

4,913,714.00

10,350.00

-93,432,384.00

-13,137,360.00

-39,029,520.00

-30,589,175.00

-7,595,806.00

8,651,145.00

-21,240,245.00

70,430,475.00

-15,543,060.00

-57,824,490.00

-45,967,650.00

15,800.00

-36,712,435.00

-16,052,710.00

-981,290.00

289,750.00

-583,020.00

-4,050,500.00

-100,400.00

-1,771,620.00

-4,468,915.00

2,040,190.00

9,450.00

-101,991,472.00

240,000.00

-19,255,369.00

-2,320.00

479,550.00

8,186,232.00

-539,910.00

-10,486,171.00

-9,021,520.00

1,090,813.00

1,300.00

71,510.00

11,554,542.00

70,091,400.00

-11,358,220.00

-427,790.00

-34,793,232.00

-1,373,548.00

-19,980.00

-106,128.00

-335,950.00

967,500.00

-1,511,540.00

-7,327,540.00

-1,681,946.00

-1,240,200.00

-9,247,480.00

3,002,965.00

-309,248.00

-7,662,700.00

-565,180.00

You might also like

- Chap 003Document12 pagesChap 003charlie simoNo ratings yet

- Case 17 Risk and ReturnDocument6 pagesCase 17 Risk and Returnnicole33% (3)

- Manila Standard Today - Business Daily Stocks Review (November 11, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (November 11, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (August 27, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (August 27, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 18, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (November 18, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (August 5, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (August 5, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 21, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (October 21, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (July 25, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (July 25, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (August 23, 2013Document1 pageManila Standard Today - Business Daily Stocks Review (August 23, 2013Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 2, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (April 2, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 13, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (May 13, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 02, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 02, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (June 3, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (June 3, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 27, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 27, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (June 9, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (June 9, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 7, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (October 7, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 20, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 20, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 1, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (December 1, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 8, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (May 8, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stock Review (October 25, 2013) IssueDocument1 pageManila Standard Today - Business Daily Stock Review (October 25, 2013) IssueManila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (September 24, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (September 24, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 22, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (May 22, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 6, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (January 6, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 20, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 20, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 17, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 17, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (September 2, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (September 2, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 10, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 10, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 20, 2013Document1 pageManila Standard Today - Business Daily Stocks Review (May 20, 2013Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 12, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (May 12, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 10, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (December 10, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 31, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (March 31, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 19, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (January 19, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 11, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (December 11, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 28, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (May 28, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 13, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 13, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 6, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (May 6, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 29, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (April 29, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 2, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (December 2, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 2, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (October 2, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 16, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 16, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 26, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (March 26, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 1, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (April 1, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 27, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (October 27, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 6, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (December 6, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 7, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (March 7, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 13, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (October 13, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 12, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (March 12, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 18, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 18, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 14, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 14, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 13, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (November 13, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 13, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (December 13, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 4, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (December 4, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 23, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 23, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 22, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (April 22, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 17, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (December 17, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 9, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 9, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 29, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (October 29, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 8, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (January 8, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (August 5, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (August 5, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (July 10, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (July 10, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 11, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (November 11, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 23, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (December 23, 2014)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 9, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 9, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 8, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 8, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Document1 pageManila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 4, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 15, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 15, 2015)Guillerson AlanguilanNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 5, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 5, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 5, 2014)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 3, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 3, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 29, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 29, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 6, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 6, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 26, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 26, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 2, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 2, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 22, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 22, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 25, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 25, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 15, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 15, 2015)Guillerson AlanguilanNo ratings yet

- The Standard - Business Daily Stocks Review (May 18, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 18, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stock Review (May 08, 2015)Document1 pageManila Standard Today - Business Daily Stock Review (May 08, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 12, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 12, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (July 3, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (July 3, 2014)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 20, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 20, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 13, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 13, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Document1 pageManila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 6, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 6, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 5, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 11, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 11, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- Skolkovo InvestmentsDocument14 pagesSkolkovo InvestmentsSegah MeerNo ratings yet

- JPMorgan SystematicStrategiesAcrossAssetsRiskFactorApproachtoAssetAllocation Dec 11 2013 PDFDocument205 pagesJPMorgan SystematicStrategiesAcrossAssetsRiskFactorApproachtoAssetAllocation Dec 11 2013 PDFMark CastellaniNo ratings yet

- Interim Order in The Matter of Astha Green Energy Ventures India LimitedDocument11 pagesInterim Order in The Matter of Astha Green Energy Ventures India LimitedShyam SunderNo ratings yet

- Problem 2.12 - SolutionDocument8 pagesProblem 2.12 - SolutiontanimaNo ratings yet

- Detecting Trend Changes with the Head and Shoulders FormationDocument5 pagesDetecting Trend Changes with the Head and Shoulders Formationsatish sNo ratings yet

- International Journal of Business and Management Invention (IJBMI)Document5 pagesInternational Journal of Business and Management Invention (IJBMI)inventionjournalsNo ratings yet

- Appendix 1: Glossary of International Accounting Standards TerminologyDocument2 pagesAppendix 1: Glossary of International Accounting Standards TerminologySabrina LeeNo ratings yet

- Inter Paper 5 Financial AccountingDocument60 pagesInter Paper 5 Financial AccountingsajtaurusNo ratings yet

- Dhirubhai Ambani'S Impact On Reliance'S Managerial Practices and Their Positive Impact On BusinessDocument3 pagesDhirubhai Ambani'S Impact On Reliance'S Managerial Practices and Their Positive Impact On BusinessqwertyNo ratings yet

- WEEK 6-7 ULO A, B, C Answer KeyDocument4 pagesWEEK 6-7 ULO A, B, C Answer Keyzee abadilla100% (1)

- Welcome KitDocument16 pagesWelcome KitConstantino L. Ramirez IIINo ratings yet

- Merchant BankingDocument4 pagesMerchant BankingSUNIL DUGANWANo ratings yet

- MOADocument18 pagesMOAAnkush GulatiNo ratings yet

- A Study On Fixed Income Securities and Their Awareness Among Indian InvestorsDocument10 pagesA Study On Fixed Income Securities and Their Awareness Among Indian InvestorsSourav LodhaNo ratings yet

- SUPPLY DEMAND JournalDocument25 pagesSUPPLY DEMAND JournalAnonymous JrCVpu100% (7)

- MBA-109 Solved AssessmentDocument11 pagesMBA-109 Solved AssessmentAnkitKumarJha86% (7)

- Singapore Property & REITs Focus: Developers' Valuations Too Cheap to IgnoreDocument310 pagesSingapore Property & REITs Focus: Developers' Valuations Too Cheap to Ignoremonami.sankarsanNo ratings yet

- Bill Ackman, Dan Loeb, Carl Icahn, and Herbalife - The Big Short War - VanityDocument4 pagesBill Ackman, Dan Loeb, Carl Icahn, and Herbalife - The Big Short War - Vanitybmichaud758No ratings yet

- Financial Ratio Analysis: Key Business RatiosDocument9 pagesFinancial Ratio Analysis: Key Business Ratiosstudent_iiml100% (1)

- Accrual vs. Cash AccountingDocument33 pagesAccrual vs. Cash AccountingAbhishek ShetyeNo ratings yet

- Brockhaus Oliver 03.12.2014Document28 pagesBrockhaus Oliver 03.12.2014RajNo ratings yet

- Chapter 15Document15 pagesChapter 15franchesca123No ratings yet

- Balancing Act. The Other Side, Nimesh Kampani, Chairman, JM FinancialDocument2 pagesBalancing Act. The Other Side, Nimesh Kampani, Chairman, JM FinancialSangitaa AdvaniNo ratings yet

- Asset Allocation & Portfolio Management Process - Lecture 2 - 2011Document45 pagesAsset Allocation & Portfolio Management Process - Lecture 2 - 2011phanquang144No ratings yet

- Chap 013Document30 pagesChap 013ducacapupu100% (1)

- CH 11.palepuDocument15 pagesCH 11.palepuVYSYAKH ANo ratings yet

- Business Finance OverviewDocument44 pagesBusiness Finance OverviewNardsdel RiveraNo ratings yet

- KeefeDocument5 pagesKeefeRochester Democrat and ChronicleNo ratings yet