Professional Documents

Culture Documents

Actividad 7marc

Uploaded by

Sofia LopezCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Actividad 7marc

Uploaded by

Sofia LopezCopyright:

Available Formats

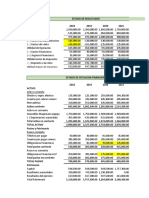

0 1 2 3 4

Ahorro 1,800,000.00 1,800,000.00 1,800,000.00 1,800,000.00

Inversión - 3,000,000.00

Costo 200,000.00 200,000.00 200,000.00 200,000.00

Depreciación 600,000.00 600,000.00 600,000.00 600,000.00

UAI - 3,000,000.00 1,000,000.00 1,000,000.00 1,000,000.00 1,000,000.00

Impuesto 300,000.00 300,000.00 300,000.00 300,000.00

Utilidad neta - 3,000,000.00 700,000.00 700,000.00 700,000.00 700,000.00

Depreciación 600,000.00 600,000.00 600,000.00 600,000.00

Valor Reposicion

Flujo - 3,000,000.00 1,300,000.00 1,300,000.00 1,300,000.00 1,300,000.00

a) 2.31 2 años 4 meses

b) $1,098,206.21

c) 35%

d) Es buena inversion ya que tiene tiene valor presente neto positivo y buena tasa interna de retorno

5

1,800,000.00

200,000.00

600,000.00

1,000,000.00

300,000.00

700,000.00

600,000.00

400,000.00

1,700,000.00

uena tasa interna de retorno

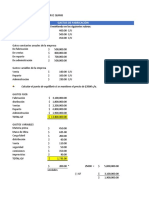

A

0 1 2 3 4 5 6

Flujo -250,000.00 61,000.00 61,000.00 61,000.00 61,000.00 61,000.00 61,000.00

TIR 12%

VAN $711

B

Flujo de

Inversión Flujo Probabilidad

efectivo

Favorable 250,000.00 68,000.00 44% 30,222.22

Desfavorable 250,000.00 61,000.00 56% 33,888.89

100% 64,111.11 flujo mas favorable

0 1 2 3 4 5 6

Flujo -250,000.00 64,111.11 64,111.11 64,111.11 64,111.11 64,111.11 64,111.11

TIR 14%

VAN $26,564.18

0 1 2 3 4 5 6

44% -250,000.00 68,000.00 68,000.00 68,000.00 68,000.00 68,000.00 68,000.00

56% -250,000.00 61,000.00 61,000.00 61,000.00 61,000.00 61,000.00 61,000.00

VAN 44% $41,961.57 44% 18,463.09

VAN 56% $14,246.28 56% 7,977.91

VAN= 26,441.01

c) La opción B es la mejor alternativa ya que nos brinda mayor presente neto

You might also like

- H. Trabajo Axel AndradeDocument16 pagesH. Trabajo Axel AndradeNathaly HigueraNo ratings yet

- Act 5 JaDocument3 pagesAct 5 JaJosé Adrián ContrerasNo ratings yet

- Reslucion de PracticaDocument5 pagesReslucion de PracticaDANICA JANETH GUEVARA PORRASNo ratings yet

- Practica 3Document2 pagesPractica 3altagracia lopezNo ratings yet

- Ejercicio 14 de Junio TirDocument12 pagesEjercicio 14 de Junio TirNikholas TovarNo ratings yet

- Ejercicios de Financiamiento 11 de OctDocument12 pagesEjercicios de Financiamiento 11 de OctLuis Angel Tovar RomoNo ratings yet

- FC LAB 9 - 6 - 2023Document8 pagesFC LAB 9 - 6 - 2023kevinNo ratings yet

- 34 Clase Van 5-2024Document3 pages34 Clase Van 5-2024Karla CozNo ratings yet

- Caso Dental S.ADocument3 pagesCaso Dental S.AJorge MuttoNo ratings yet

- Practica 2 FinanzasDocument4 pagesPractica 2 FinanzasMarco Antonio Dco Vega RomanNo ratings yet

- Ej 1Document8 pagesEj 1naydelin.rh.2018No ratings yet

- VPNDocument16 pagesVPNOswaldo GurrolaNo ratings yet

- Libro 1Document4 pagesLibro 1MarceNo ratings yet

- FlujoimpDocument9 pagesFlujoimpPame LópezNo ratings yet

- Ejemplos VA 2023 - ResueltoDocument8 pagesEjemplos VA 2023 - ResueltoLuisfer HernandezNo ratings yet

- Tema 1 - Punto de Equilibrio (Autoguardado)Document10 pagesTema 1 - Punto de Equilibrio (Autoguardado)Max FloresNo ratings yet

- Formato Presupuesto de TesoreriaDocument14 pagesFormato Presupuesto de TesoreriapamelachavezreyesNo ratings yet

- Casanova-Michael-CUADRE DE BALANCE TDocument1 pageCasanova-Michael-CUADRE DE BALANCE TMichael Francisco Casanova BorgesNo ratings yet

- Análisis VPN y TIRDocument2 pagesAnálisis VPN y TIRJuan DavidNo ratings yet

- Actividad de Aprendizaje Matematica Financiera Unidad 2Document8 pagesActividad de Aprendizaje Matematica Financiera Unidad 2alexandra LopezNo ratings yet

- 2023 Caso 3 - Preparación de Estados Financieros - Grupo 5 (09!07!23)Document15 pages2023 Caso 3 - Preparación de Estados Financieros - Grupo 5 (09!07!23)Giancarlo Gonzales CampomanesNo ratings yet

- 3er Ejercicio Ing FinancieraDocument12 pages3er Ejercicio Ing FinancierajjuniorrodriguezNo ratings yet

- Formato Presupuesto de TesoreriaDocument10 pagesFormato Presupuesto de TesoreriapamelachavezreyesNo ratings yet

- Casos de Analisis FinancieraDocument27 pagesCasos de Analisis FinancierajessicaNo ratings yet

- Ejercicio Resuelto Estados Financieros Id 0503 26 Sept 22-1Document12 pagesEjercicio Resuelto Estados Financieros Id 0503 26 Sept 22-1Nancy Sanchez BalderasNo ratings yet

- Casos y Lab de Financiamiento Cap 10Document31 pagesCasos y Lab de Financiamiento Cap 10Luis Angel Tovar RomoNo ratings yet

- Solución Ejercicio Presupuesto - Hoja 1Document1 pageSolución Ejercicio Presupuesto - Hoja 1Angeles MolinaNo ratings yet

- Act Apren3 VOOODocument9 pagesAct Apren3 VOOOValeria OrtizNo ratings yet

- Ejercicios ContabilidadDocument21 pagesEjercicios ContabilidadCarolina SalazarNo ratings yet

- Lab TirDocument4 pagesLab TirGillermo Andrs Ayala QuinterosNo ratings yet

- Valorización Caso 2Document17 pagesValorización Caso 2Eduardo c. BenaventeNo ratings yet

- Practica 3.-Flujo de EfectivoDocument9 pagesPractica 3.-Flujo de EfectivoJaqueline AlvaradoNo ratings yet

- Caso Practico 10-07-2023-Osi...Document16 pagesCaso Practico 10-07-2023-Osi...MAICKEL SANCHEZNo ratings yet

- Flujo de EfectivoDocument2 pagesFlujo de EfectivoCuevas Marin Eunice MarleneNo ratings yet

- Punto de EquilibrioDocument253 pagesPunto de Equilibrioandrea quimisNo ratings yet

- Flujo de Efectivo Cuatri 8Document8 pagesFlujo de Efectivo Cuatri 8Pame LópezNo ratings yet

- Contabilidad de Operaciones (1)Document9 pagesContabilidad de Operaciones (1)Mary Luz Álvarez PomaresNo ratings yet

- Flujo Efvo Octavio 2024Document3 pagesFlujo Efvo Octavio 2024reyesnidia347No ratings yet

- Tarea AsientosDocument17 pagesTarea AsientosCristal Vázquez MoralesNo ratings yet

- ExportacionDocument1 pageExportacionJuan JoseNo ratings yet

- Caso Eeff IntegralDocument4 pagesCaso Eeff IntegralMAICKEL SANCHEZNo ratings yet

- Actividad Evaluativa Eje 3-SoluciónDocument4 pagesActividad Evaluativa Eje 3-SoluciónLucho CardenasNo ratings yet

- SISTEMAS DE AMORTIZACIÓN (Con Formulas)Document7 pagesSISTEMAS DE AMORTIZACIÓN (Con Formulas)Anakaren MauleonNo ratings yet

- Practica 3Document2 pagesPractica 3gjosselyn33No ratings yet

- Beneficios $ - $ 300,000.00 $ 300,000.00 $ 600,000.00 $ 600,000.00Document3 pagesBeneficios $ - $ 300,000.00 $ 300,000.00 $ 600,000.00 $ 600,000.00Luis Enrique Anguiano GarcíaNo ratings yet

- Balance de Comprobacion Guzman QuitoDocument3 pagesBalance de Comprobacion Guzman QuitoGuzmán GiancarloNo ratings yet

- ManzanaDocument8 pagesManzanaAndrea HernandezNo ratings yet

- Balanza de Comprobacion EneroDocument2 pagesBalanza de Comprobacion Enerojfernandezdominguez94949No ratings yet

- Ejercicos en ClaseDocument5 pagesEjercicos en Clasejorge papanoel69live.com.mxNo ratings yet

- Retro Ada 3 Perpetuo Completo Nov 22Document10 pagesRetro Ada 3 Perpetuo Completo Nov 22carlos diazNo ratings yet

- Balance de ComprobacionDocument2 pagesBalance de ComprobacionJose JaimesNo ratings yet

- Ba LanzaDocument2 pagesBa LanzaPepito EL DE LOS CuentosNo ratings yet

- Esf Comparativo Pract 2 Ambar 404Document8 pagesEsf Comparativo Pract 2 Ambar 404MARCELO ANTONIO RAMIREZ HERNANDEZNo ratings yet

- PRAC3AMBAR404TENDENCIASDocument6 pagesPRAC3AMBAR404TENDENCIASMARCELO ANTONIO RAMIREZ HERNANDEZNo ratings yet

- FlacoDocument12 pagesFlacoVíctor GNo ratings yet

- Estudio de Caso 2 Jazlin Segura SDocument2 pagesEstudio de Caso 2 Jazlin Segura Sjazlinsegura16No ratings yet

- Análisis e Interpretación de Estados FinancierosDocument25 pagesAnálisis e Interpretación de Estados FinancierosElizabeth De Jesus SantosNo ratings yet

- Tabla de Costos Harina de PlatanoDocument6 pagesTabla de Costos Harina de Platanojhon alexander herrera maldonadoNo ratings yet

- Actividad 2.3 ContabilidadDocument3 pagesActividad 2.3 ContabilidadIsrael GarciaNo ratings yet