Professional Documents

Culture Documents

Manila Standard Today - Business Daily Stocks Review (June 14, 2012)

Uploaded by

Manila Standard TodayCopyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Manila Standard Today - Business Daily Stocks Review (June 14, 2012)

Uploaded by

Manila Standard TodayCopyright:

B2 FRIDAY

Business

ManilaStandardToday

JUNE 15, 2012

mst_biz@manilastandardtoday.com extrastory2000@gmail.com

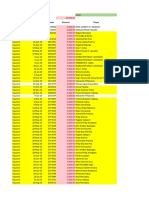

MST Business Daily Stocks Review

M

S

T

Thursday, June 14, 2012

52 Weeks

High Low STOCKS

Previous

Low

Close Change Volume

Net Foreign

Close

High

Trade/Buying

63.00

68.80

0.70

557.00

1.71

22.50

18.64

68.00

2.36

460.00

38.35

88.80

2.00

69.80

61.00

349.00

42.50

138.90

900.00

100.00

1.78

63.00 (7.89)

68.95 (0.51)

0.70 0.00

559.00 (0.18)

1.79 4.07

22.50 (3.43)

18.64 (1.38)

68.00 (7.48)

2.37 (1.25)

460.00 0.00

38.35 (2.04)

88.90 (0.22)

2.00 2.56

71.00 (0.28)

61.00 5.17

350.00 0.29

44.00 2.09

138.90 (2.18)

900.00 (7.22)

100.10 0.10

1.78 0.00

1,627,740

773,730

120,000

13,540

41,000

12,500

788,100

3,320

8,000

540

5,000

2,142,210

102,000

399,810

1,000

8,900

242,700.00

603,500

100

82,650

162,000

(9,752,963.00)

2,915,044.50

32.55

9.00

19.00

1.36

29.00

1.28

21.80

8.23

2.54

2.48

8.84

5.81

6.12

9.60

16.10

69.75

20.90

0.0130

11.40

3.95

0.750

105.10

52.50

1.48

1.45

1.66

24.40

17.00

239.00

2.75

10.06

10.26

8.10

8.50

2.90

2.54

29.00

114.00

1.75

1.84

0.127

3.86

2.07

1.20

61.50

1.38

0.690

0.91

32.55 (3.13)

9.03 (1.63)

19.02 (4.90)

1.38 0.00

29.35 1.73

1.29 (0.77)

22.40 0.00

8.23 (1.20)

2.78 11.65

2.48 0.00

9.17 (0.11)

5.85 0.00

6.15 1.49

10.40 4.00

16.46 2.24

69.80 (0.85)

20.90 0.00

0.0130 (7.14)

11.40 0.00

3.95 (1.00)

0.760 (8.43)

105.20 (2.50)

52.50 (0.76)

1.54 (2.53)

1.45 0.00

2.20 25.00

24.40 (2.40)

17.22 0.12

240.00 (1.23)

2.75 0.00

10.12 0.20

10.26 (2.29)

8.30 1.22

8.50 (4.71)

2.92 (2.01)

2.54 (1.17)

29.00 0.00

114.50 0.26

1.75 (2.78)

1.84 (0.54)

0.127 0.79

3.86 (1.03)

2.18 4.31

1.20 (1.64)

61.50 (5.60)

1.46 (2.67)

0.690 (2.82)

0.93 2.20

5,792,400

73,500

17,100

161,000

300

123,000

113,600

8,080,700

3,636,000

77,000

37,100

25,119,000

1,011,300

7,600

6,662,300

725,740

400

11,900,000

400

93,000

608,000

645,250

830

862,000

28,000

20,000

1,912,400

232,800

156,130

2,353,000

2,024,800

9,600

149,700

2,800

1,341,000

5,000

1,000

437,660

2,737,000

3,000

100,000

1,688,000

254,000

1,521,000

5,409,790

8,872,000

715,000

62,000

(110,199,845.00)

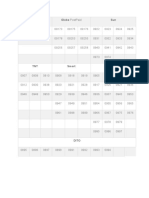

HOLDING FIRMS

0.69

0.69

50.25

48.00

11.56

11.38

4.65

4.60

5.11

5.00

1.87

1.74

458.00

443.00

55.60

54.55

2.50

2.50

4.00

3.94

487.00

484.00

4.37

4.35

33.30

32.60

3.30

2.60

5.86

5.80

1.08

1.04

2.49

2.43

4.13

4.05

4.70

4.65

0.0500

0.0490

0.450

0.430

2.10

2.10

0.320

0.320

705.00

699.50

1.38

1.34

1.25

1.19

0.3500

0.3450

0.520

0.500

0.69 0.00

48.00 (4.48)

11.46 0.35

4.65 1.09

5.05 (2.51)

1.87 0.00

449.80 1.95

54.70 (2.32)

2.50 0.00

3.94 (0.25)

484.00 (0.04)

4.37 0.46

32.70 (1.51)

2.97 7.22

5.84 (0.34)

1.05 (1.87)

2.45 (1.21)

4.08 (0.97)

4.70 2.17

0.0500 (3.85)

0.440 (2.22)

2.10 1.45

0.320 (1.54)

700.00 (0.14)

1.34 (3.60)

1.19 (8.46)

0.3500 0.00

0.500 (5.66)

100,000

3,611,350

28,394,900

256,000

300,200

7,000

501,890

2,300,400

78,000

484,000

125,230

20,000

405,700

187,000

945,400

802,000

737,000

13,106,000

59,000

2,590,000

60,000

29,000

530,000

221,060

422,000

31,000

540,000

838,000

70.00

46.00

76.80

50.00

1.82

0.69

512.00

370.00

1.95

1.42

23.90

12.50

80.00

40.00

3.26

1.91

775.00

475.20

29.00

3.00

93.50

60.00

3.06

1.30

16.85

41.00

80.00

52.00

539.00

204.80

44.40

25.45

151.50

77.00

1390.00 950.00

140.00

58.00

2.06

1.43

Banco de Oro Unibank Inc.

Bank of PI

Bankard, Inc.

China Bank

BDO Leasing & Fin. Inc.

COL Financial

Eastwest Bank

First Metro Inv.

I-Remit Inc.

Manulife Fin. Corp.

Maybank ATR KE

Metrobank

Natl Reinsurance Corp.

Phil. National Bank

Philippine Trust Co.

PSE Inc.

RCBC `A

Security Bank

Sun Life Financial

Union Bank

Vantage Equities

68.40

69.30

0.70

560.00

1.72

23.30

18.90

73.50

2.40

460.00

39.15

89.10

1.95

71.20

58.00

349.00

43.10

142.00

970.00

100.00

1.78

FINANCIAL

63.95

69.50

0.74

560.00

1.79

23.30

19.00

70.00

2.37

461.00

38.55

89.60

2.00

71.20

61.00

350.00

44.00

139.00

940.00

101.10

1.78

35.50

26.50

13.58

7.32

23.50

11.98

1.86

0.97

54.90

26.00

1.65

1.08

102.80

3.02

2.88

2.24

3.07

2.30

8.33

7.41

7.06

4.83

6.28

2.80

25.00

5.80

15.58

12.50

67.20

51.50

31.50

22.50

0.10

0.0095

13.50

7.80

9.00

4.71

2.35

0.95

120.00

80.00

91.25

25.00

8.40

1.04

1.55

0.99

3.20

1.05

24.70

17.94

15.30

8.12

295.00

215.00

3.00

1.96

17.40

9.70

14.00

10.30

15.24

9.01

9.50

5.25

2.55

1.01

3.49

2.01

33.00

27.70

132.60

105.70

1.90

1.25

2.50

1.85

0.250

0.112

5.46

2.92

3.62

1.99

1.41

0.90

68.00

36.20

1.12

0.285

1.22

0.68

Aboitiz Power Corp.

Agrinurture Inc.

Alaska Milk Corp.

Alliance Tuna Intl Inc.

Alphaland Corp.

Alsons Cons.

Asiabest Group

Bloomberry

Calapan Venture

Chemrez Technologies Inc.

Cirtek Holdings (Chips)

Energy Devt. Corp. (EDC)

EEI

Federal Chemicals

First Gen Corp.

First Holdings A

Ginebra San Miguel Inc.

Greenergy

Holcim Philippines Inc.

Integ. Micro-Electronics

Ionics Inc

Jollibee Foods Corp.

Liberty Flour

LMG Chemicals

Mabuhay Vinyl Corp.

Manchester Intl. A

Manila Water Co. Inc.

Megawide

Mla. Elect. Co `A

Pepsi-Cola Products Phil.

Petron Corporation

Phinma Corporation

Phoenix Petroleum Phils.

Republic Cement `A

RFM Corporation

Roxas Holdings

San Miguel Brewery Inc.

San Miguel Corp `A

Seacem

Splash Corporation

Swift Foods, Inc.

Tanduay Holdings

TKC Steel Corp.

Trans-Asia Oil

Universal Robina

Victorias Milling

Vitarich Corp.

Vulcan Indl.

33.60

9.18

20.00

1.38

28.85

1.30

22.40

8.33

2.49

2.48

9.18

5.85

6.06

10.00

16.10

70.40

20.90

0.0140

11.40

3.99

0.830

107.90

52.90

1.58

1.45

1.76

25.00

17.20

243.00

2.75

10.10

10.50

8.20

8.92

2.98

2.57

29.00

114.20

1.80

1.85

0.126

3.90

2.09

1.22

65.15

1.50

0.710

0.91

INDUSTRIAL

33.60

9.20

19.02

1.40

29.35

1.29

23.50

8.34

2.96

2.48

9.18

5.86

6.28

10.40

16.62

70.50

20.90

0.0140

11.40

3.98

0.860

107.90

52.50

1.58

1.45

2.20

25.15

17.50

242.00

2.79

10.20

10.40

8.30

8.90

3.00

2.54

29.00

114.50

1.76

1.84

0.127

3.90

2.18

1.23

62.50

1.55

0.720

0.93

1.18

0.65

59.90

35.50

13.48

8.00

4.60

3.00

6.98

0.260

3.15

1.49

437.00

272.00

59.45

30.50

4.19

1.03

5.25

3.30

5.22

2.90

34.80

19.00

4.19

2.27

6.95

4.00

1.54

0.61

3.82

1.500

4.45

2.56

6.24

2.10

0.0770

0.054

0.82

0.44

4.10

1.56

0.490

0.285

699.00

450.00

1.78

1.00

1.57

1.14

0.620

0.056

1.370

0.178

Abacus Cons. `A

Aboitiz Equity

Alliance Global Inc.

Anscor `A

Asia Amalgamated A

ATN Holdings A

Ayala Corp `A

DMCI Holdings

F&J Prince A

Filinvest Dev. Corp.

GT Capital

House of Inv.

JG Summit Holdings

Jolliville Holdings

Lopez Holdings Corp.

Lodestar Invt. Holdg.Corp.

Marcventures Hldgs., Inc.

Metro Pacific Inv. Corp.

Minerales Industrias Corp.

Pacifica `A

Prime Orion

Republic Glass A

Sinophil Corp.

SM Investments Inc.

Solid Group Inc.

South China Res. Inc.

Wellex Industries

Zeus Holdings

0.69

50.25

11.42

4.60

5.18

1.87

441.20

56.00

2.50

3.95

484.20

4.35

33.20

2.77

5.86

1.07

2.48

4.12

4.60

0.0520

0.450

2.07

0.325

701.00

1.39

1.30

0.3500

0.530

2.82

1.70

22.40

13.36

6.12

3.08

9.00

2.26

5.66

0.26

2.85

1.20

1.65

1.07

1.16

0.67

0.90

0.54

3.06

1.76

1.35

0.98

3.80

1.21

2.14

0.65

2.48

1.51

0.80

0.215

0.990

0.072

38.10

12.50

4.77

1.80

18.86

10.00

2.70

1.74

9.47

6.50

18.20

10.90

1.14

0.64

4.30

2.60

43.00

28.60

14.76

1.60

0.80

0.45

0.5300

0.0660

98.15

62.50

9.70

5.40

5.90

1.45

1270.00 825.00

10.34

6.18

69.00

43.40

6.00

4.00

4.29

2.20

34.50

0.123

3.87

1.16

0.0760

0.040

5.1900

2.900

3.79

1.58

11.68

5.90

4.28

2.65

2.35

0.92

3.96

2.70

0.84

0.57

3.00

1.00

9.60

6.50

21.00

17.20

8.58

4.50

3.32

1.05

10.00

4.60

17.18

14.50

2886.00 2096.00

0.48

0.23

23.75

10.68

3.30

2.40

0.79

0.26

PROPERTY

A. Brown Co., Inc.

2.56

2.57

2.56

2.57 0.39

4,000

Ayala Land `B

21.50

22.05

21.50

21.90 1.86

12,745,800

Belle Corp. `A

4.80

4.78

4.70

4.70 (2.08)

1,007,000

Cebu Holdings

5.87

6.00

5.88

5.88 0.17

39,800

Century Property

1.47

1.47

1.42

1.43 (2.72)

740,000

City & Land Dev.

2.44

2.46

2.38

2.42 (0.82)

78,000

Cityland Dev. `A

1.15

1.16

1.16

1.16 0.87

56,000

Cyber Bay Corp.

0.79

0.79

0.79

0.79 0.00

580,000

Empire East Land

0.710

0.720

0.690

0.690 (2.82)

8,830,000

Global-Estate

1.71

1.70

1.67

1.70 (0.58)

588,000

Filinvest Land,Inc.

1.20

1.22

1.18

1.20 0.00

13,041,000

Highlands Prime

1.72

1.72

1.71

1.71 (0.58)

77,000

Interport `A

1.12

1.12

1.12

1.12 0.00

5,000

Megaworld Corp.

1.96

1.98

1.93

1.93 (1.53)

104,338,000

MRC Allied Ind.

0.1820

0.1860

0.1820

0.1860 2.20

1,130,000

Phil. Estates Corp.

0.6900

0.7000

0.6600

0.6900 0.00

6,277,000

Phil. Tob. Flue Cur & Redry

14.60

14.62

14.62

14.62 0.14

300

Polar Property Holdings

3.90

3.90

3.80

3.90 0.00

76,000

Robinsons Land `B

16.72

16.78

16.34

16.62 (0.60)

3,527,100

Rockwell

3.12

3.19

3.12

3.12 0.00

63,000

Shang Properties Inc.

2.48

2.48

2.45

2.45 (1.21)

26,000

SM Development `A

6.09

6.20

6.08

6.09 0.00

1,130,900

SM Prime Holdings

12.60

12.80

12.40

12.72 0.95

3,948,900

Sta. Lucia Land Inc.

0.68

0.68

0.68

0.68 0.00

100,000

Vista Land & Lifescapes

4.060

4.160

3.920

4.050 (0.25)

4,448,000

S E R V I C E S

ABS-CBN

35.50

35.50

34.90

35.00 (1.41)

7,300

Acesite Hotel

14.70

15.20

14.20

14.90 1.36

80,000

APC Group, Inc.

0.690

0.690

0.640

0.680 (1.45)

1,201,000

Boulevard Holdings

0.1450

0.1500

0.1420

0.1430 (1.38)

8,480,000

Calata Corp.

14.00

14.70

9.00

9.51 (32.07)

40,584,600

Cebu Air Inc. (5J)

67.65

67.65

65.00

65.10 (3.77)

882,840

DFNN Inc.

6.15

6.49

5.95

6.25 1.63

392,000

Easy Call Common

3.25

3.26

3.26

3.26 0.31

6,000

Globe Telecom

1092.00

1110.00

1020.00 1020.00 (6.59)

131,265

GMA Network Inc.

10.18

10.16

10.00

10.02 (1.57)

225,800

I.C.T.S.I.

74.00

74.45

72.00

72.00 (2.70)

846,730

IPeople Inc. `A

5.20

5.25

5.25

5.25 0.96

5,000

IP Converge

4.20

4.25

4.19

4.19 (0.24)

13,000,000

IP E-Game Ventures Inc.

0.040

0.042

0.041

0.042 5.00

24,200,000

IPVG Corp.

1.06

1.07

1.04

1.05 (0.94)

503,000

Island Info

0.0540

0.0520

0.0500

0.0520 (3.70)

210,000

ISM Communications

2.6000

2.6900

2.6100

2.6100 0.38

36,000

JTH Davies Holdings Inc.

2.46

2.50

2.40

2.50 1.63

253,000

Leisure & Resorts

6.51

6.71

6.53

6.70 2.92

13,100

Liberty Telecom

2.79

2.80

2.71

2.80 0.36

44,000

Lorenzo Shipping

1.60

1.45

1.45

1.45 (9.38)

10,000

Macroasia Corp.

2.85

2.85

2.85

2.85 0.00

3,000

Manila Bulletin

0.68

0.68

0.68

0.68 0.00

10,000

Manila Jockey

2.29

2.27

2.09

2.10 (8.30)

1,048,000

Metro Pacific Tollways

7.00

7.00

6.10

6.10 (12.86)

2,500

Pacific Online Sys. Corp.

20.00

20.00

20.00

20.00 0.00

8,600

PAL Holdings Inc.

7.18

7.23

7.17

7.17 (0.14)

31,800

Paxys Inc.

2.94

2.99

2.88

2.90 (1.36)

623,000

Phil. Racing Club

9.10

9.50

9.48

9.48 4.18

152,000

Philweb.Com Inc.

15.38

15.38

14.00

14.92 (2.99)

166,000

PLDT Common

2440.00

2444.00

2350.00 2350.00 (3.69)

127,120

PremiereHorizon

0.320

0.315

0.315

0.315 (1.56)

50,000

Puregold

26.50

26.45

25.50

25.80 (2.64)

710,900

Touch Solutions

3.85

3.80

3.80

3.80 (1.30)

100,000

Transpacific Broadcast

2.62

2.70

2.54

2.70 3.05

3,000

Waterfront Phils.

0.435

0.440

0.420

0.420 (3.45)

610,000

0.0083

6.20

25.20

31.00

0.380

30.35

34.00

2.51

50.85

1.21

1.82

2.070

0.085

0.087

34.80

12.76

1.100

8.40

0.032

7.14

28.95

14.18

0.058

252.00

0.029

Abra Mining

Apex `A

Atlas Cons. `A

Atok-Big Wedge `A

Basic Energy Corp.

Benguet Corp `A

Benguet Corp `B

Century Peak Metals Hldgs

Dizon

Geograce Res. Phil. Inc.

Lepanto `A

Lepanto `B

Manila Mining `A

Manila Mining `B

Nickelasia

Nihao Mineral Resources

Omico

Oriental Peninsula Res.

Oriental Pet. `A

Petroenergy Res. Corp.

Philex `A

PhilexPetroleum

Philodrill Corp. `A

Semirara Corp.

United Paragon

0.0040

4.80

17.30

29.50

0.250

21.70

21.85

1.48

31.50

0.68

1.420

1.490

0.0680

0.0670

31.50

8.70

0.7000

5.170

0.0170

5.92

24.15

39.00

0.043

222.40

0.0180

47.90

27.30

570.00

520.00

11.02

6.00

80.00

74.50

1050.00 990.00

6.00

0.87

ABS-CBN Holdings Corp.

Ayala Corp. Pref `A

First Gen G

GMA Holdings Inc.

SMC Preferred 1

SMPFC Preferred

Swift Pref

34.25

544.00

101.00

10.18

75.15

1020.00

1.03

1.35

Megaworld Corp. Warrants

0.97

0.0036

3.01

14.50

20.00

0.148

15.00

14.50

1.62

4.35

0.50

0.5900

0.6700

0.035

0.035

15.04

2.08

0.008

2.12

0.012

5.10

17.08

3.00

0.013

161.10

0.013

0.62

MINING & OIL

0.0040

0.0040

4.84

4.70

17.30

17.20

29.90

29.90

0.250

0.245

24.90

21.60

23.00

21.85

1.50

1.44

32.50

29.50

0.70

0.67

1.410

1.380

1.490

1.450

0.0670

0.0650

0.0670

0.0660

31.30

30.80

8.74

8.32

0.7300

0.7000

5.230

5.020

0.0170

0.0170

5.90

5.90

24.00

23.85

38.70

37.05

0.044

0.041

224.00

214.80

0.0180

0.0170

PREFERRED

33.00

544.00

101.20

10.06

75.50

1022.00

1.04

33.00

544.00

101.00

10.00

75.30

1018.00

1.04

WARRANTS & BONDS

0.99

0.96

2,140,746.00

99,689,417.00

7,232,445.00

254,500.00

5,684,000.00

19,718,406.00

5,826,330.00

(14,000.00)

(44,237,306.00)

505,190.00

124,000.00

37,622,293.00

(658,243.00)

13,975,888.00

(5,599,983.00)

(91,090.00)

(23,840.00)

(5,968,422.00)

15,100.00

(42,146,850.00)

5,605,788.00

2,185,450.00

(15,697,964.00)

772,680.00

43,159,892.00

(437,500.00)

(142,353,802.00)

733,900.00

(96,164,921.50)

(212,212,238.00)

972,580.00

(55,550.00)

111,187,758.00

12,196,505.00

34,016,840.00

4,509,625.00

2,783,468.00

(584,930.00)

(4,211,610.00)

(9,000.00)

(34,111,535.00)

(1,190.00)

94,004,350.00

(250,950.00)

920,710.00

(80,474,670.00)

7,026,656.00

869,461.00

5,138,970.00

(16,106,980.00)

(29,532.00)

(4,393,374.00)

(23,940,951.00)

(165,625.00)

(51,374,100.00)

(410,048.50)

4,100.00

(174,780.00)

(1,424,700.00)

(2,287,628.00)

(166,835,820.00)

2,640,765.00

0.0040 0.00

4.84 0.83

17.30 0.00

29.90 1.36

0.250 0.00

24.90 14.75

23.00 5.26

1.44 (2.70)

30.60 (2.86)

0.68 0.00

1.400 (1.41)

1.460 (2.01)

0.0650 (4.41)

0.0660 (1.49)

30.85 (2.06)

8.50 (2.30)

0.7300 4.29

5.160 (0.19)

0.0170 0.00

5.90 (0.34)

23.85 (1.24)

37.10 (4.87)

0.041 (4.65)

216.00 (2.88)

0.0170 (5.56)

3,000,000

3,000

304,800

4,500

100,000

88,000

28,800

173,000

293,400

1,707,000

19,357,000

9,348,000

70,670,000

16,740,000

1,326,400

897,500

57,000

1,773,600

32,200,000

200

1,075,300

356,900

243,900,000

458,910

12,800,000

33.00 (3.65)

544.00 0.00

101.20 0.20

10.00 (1.77)

75.50 0.47

1018.00 (0.20)

1.04 0.97

15,900

1,730

15,610

5,051,300

37,080

12,465

1,000

(524,700.00)

0.99 2.06

903,000

234,600.00

8,610.00

(29,900.00)

(12,250.00)

(150,765.00)

12,240.00

(1,014,100.00)

3,100.00

(2,553.00)

(1,180.00)

(4,313,965.00)

1,501,575.00

84,000.00

(17,451,496.00)

(321,500.00)

81,600.00

You might also like

- DirectoryDocument16 pagesDirectoryFloridel VeloriaNo ratings yet

- TaglineDocument4 pagesTaglineSyntax Kofi100% (1)

- Recommended Cases For Obligations and ContractsDocument6 pagesRecommended Cases For Obligations and ContractsSittie Aina Munder100% (1)

- Customer Contacts and Subsidiary ContactsDocument5 pagesCustomer Contacts and Subsidiary ContactsRalph V. VillanuevaNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 22, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (November 22, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 20, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (November 20, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (July 31, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (July 31, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 27, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (December 27, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 4, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (December 4, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 30, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (May 30, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 25, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (May 25, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 22, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (October 22, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 29, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (May 29, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stock Review (September 26, 2012)Document1 pageManila Standard Today - Business Daily Stock Review (September 26, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 21, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (May 21, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 19, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (March 19, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 18, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (April 18, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (June 22, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (June 22, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (June 8, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (June 8, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 12, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (April 12, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 27, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (November 27, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 31, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (May 31, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 26, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (December 26, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 19, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (November 19, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 10, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (May 10, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stock Review (September 27, 2012)Document1 pageManila Standard Today - Business Daily Stock Review (September 27, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 4, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (December 4, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (June 15, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (June 15, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 21, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (March 21, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 23, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (January 23, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 16, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (October 16, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 21, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (November 21, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 16, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (May 16, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 1, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (October 1, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 14, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (March 14, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 30, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (October 30, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (July 26, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (July 26, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 11, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (February 11, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 7, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (February 7, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - August 24, 2012 IssueDocument1 pageManila Standard Today - August 24, 2012 IssueManila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 25, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (April 25, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 04, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (May 04, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stock Review (August 15, 2012)Document1 pageManila Standard Today - Business Daily Stock Review (August 15, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 6, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (December 6, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 12, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (December 12, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 10, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (April 10, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 16, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (January 16, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 19, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (December 19, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 14, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (December 14, 2012)Manila Standard TodayNo ratings yet

- Formula DrainaseDocument58 pagesFormula DrainaseRiskiawan ErtantoNo ratings yet

- Sistema de AguaDocument10 pagesSistema de AguaNANDO 15No ratings yet

- Debt FundsDocument36 pagesDebt FundsArmstrong CapitalNo ratings yet

- Aprovechamiento Forestal Hato San MartínDocument55 pagesAprovechamiento Forestal Hato San MartínMoisesGuerreroNo ratings yet

- Manila Standard Today - Business Weekly Stock Review (August 26-29, 2014)Document1 pageManila Standard Today - Business Weekly Stock Review (August 26-29, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 24, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (April 24, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Document1 pageManila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Manila Standard TodayNo ratings yet

- Stocks Monitoring - Blue Chips: SN Company Code Date 26-Jun-18 2-Dec-18 4-Dec-18 19-Jun-19 25-Mar-20Document3 pagesStocks Monitoring - Blue Chips: SN Company Code Date 26-Jun-18 2-Dec-18 4-Dec-18 19-Jun-19 25-Mar-20Marcus AmabaNo ratings yet

- Manila Standard Today - Business Weekly Stock Review (September 15-18, 2014)Document1 pageManila Standard Today - Business Weekly Stock Review (September 15-18, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stock Review (September 28, 2012)Document1 pageManila Standard Today - Business Daily Stock Review (September 28, 2012)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 30, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (January 30, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 27, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (April 27, 2012)Manila Standard TodayNo ratings yet

- Project Cost Overrun ScenariosDocument318 pagesProject Cost Overrun ScenariosAli SibtainNo ratings yet

- 3Document81 pages3Suraj DasNo ratings yet

- The Standard - Business Daily Stocks Review (June 9, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 9, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 4, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 5, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 8, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 8, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 23, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (December 23, 2014)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 3, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 3, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 2, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 2, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 26, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 26, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Document1 pageManila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 15, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 15, 2015)Guillerson AlanguilanNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 5, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 5, 2014)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 29, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 29, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 25, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 25, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 22, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 22, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 6, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 6, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 20, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 20, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (July 3, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (July 3, 2014)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 18, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 18, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 15, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 15, 2015)Guillerson AlanguilanNo ratings yet

- Manila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Document1 pageManila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 13, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 13, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 12, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 12, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 11, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 11, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 6, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 6, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stock Review (May 08, 2015)Document1 pageManila Standard Today - Business Daily Stock Review (May 08, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 5, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 14, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 14, 2014)Manila Standard TodayNo ratings yet

- Negotiable Instruments Law (NIL) Syllabus: ©attykjmbDocument5 pagesNegotiable Instruments Law (NIL) Syllabus: ©attykjmbJANE MARIE DOROMALNo ratings yet

- Final AbdDocument1,086 pagesFinal AbdJenbert SantiagoNo ratings yet

- TV Patrol.Document7 pagesTV Patrol.Kem Magno100% (1)

- SQL CC 10092020 Hpi Data TableDocument314 pagesSQL CC 10092020 Hpi Data TableRodel DerlaNo ratings yet

- Manila Standard Today - Business Weekly Stocks Review (September 15, 2013)Document1 pageManila Standard Today - Business Weekly Stocks Review (September 15, 2013)Manila Standard TodayNo ratings yet

- Language Preference of MSU STUDENTS IN ACCESSING AND READING ONLINE NEWS AND SOCIAL NETWORKING SITESDocument216 pagesLanguage Preference of MSU STUDENTS IN ACCESSING AND READING ONLINE NEWS AND SOCIAL NETWORKING SITESShaira MPNo ratings yet

- Sample SLP 2019Document2 pagesSample SLP 2019ChaNo ratings yet

- Philhealth'S Accredited Collecting Agents: (Under DOF Circular 01-2017)Document2 pagesPhilhealth'S Accredited Collecting Agents: (Under DOF Circular 01-2017)car3laNo ratings yet

- SY Family (Group 1)Document6 pagesSY Family (Group 1)John miguel ChavezNo ratings yet

- CodesDocument12 pagesCodesCham ArevaloNo ratings yet

- Jollibee - WikipediaDocument23 pagesJollibee - WikipediaNick Jargon Pollante NacionNo ratings yet

- List of Banks in DumagueteDocument3 pagesList of Banks in DumagueteZacOonnee100% (1)

- Globe Globe Postpaid SunDocument5 pagesGlobe Globe Postpaid SunGalo FalgueraNo ratings yet

- PSBank Home Loan - List Accredited DevelopersDocument2 pagesPSBank Home Loan - List Accredited DevelopersAlora Uy Guerrero0% (1)

- PTC Unit 1516 New Proposal Rev 1.1Document13 pagesPTC Unit 1516 New Proposal Rev 1.1CoachMike Dela CruzNo ratings yet

- VIP Guests at National Thanksgiving MassDocument104 pagesVIP Guests at National Thanksgiving MassLian Las PinasNo ratings yet

- DZMM Programming Grid September 2019Document3 pagesDZMM Programming Grid September 2019Franco ReyesNo ratings yet

- 317 East 32nd Street - Lead SheetDocument2 pages317 East 32nd Street - Lead SheetSteinar RefsdalNo ratings yet

- Nego CasesDocument5 pagesNego CasesDESSA JOY PARAGASNo ratings yet

- Date Mm/dd/yyyy Name of Customer Bank Check # AmountDocument2 pagesDate Mm/dd/yyyy Name of Customer Bank Check # AmountDerick DalisayNo ratings yet

- Incentive Claim Form April MauDocument136 pagesIncentive Claim Form April MauJhay AcebucheNo ratings yet

- Phil Tech GuideDocument3 pagesPhil Tech GuideAnton CeguerraNo ratings yet

- Oblicon Set 2Document1 pageOblicon Set 2Limar Anasco EscasoNo ratings yet

- Employer-Employee RelationshipDocument3 pagesEmployer-Employee RelationshipvinaNo ratings yet

- Milestones 1953Document7 pagesMilestones 1953Sharmine TejanoNo ratings yet